A4A News

NASAA Raises The Bar On Financial Advisor CE

NASAA, the 105-year-old association for state financial regulators, has upped the bar on financial advisor CE/CPE. NASAA's IAR CE requirements are, in some areas, more rigorous than CE/CPE standards set by CFP Board and NASBA/AICPA. Here's what's happening:

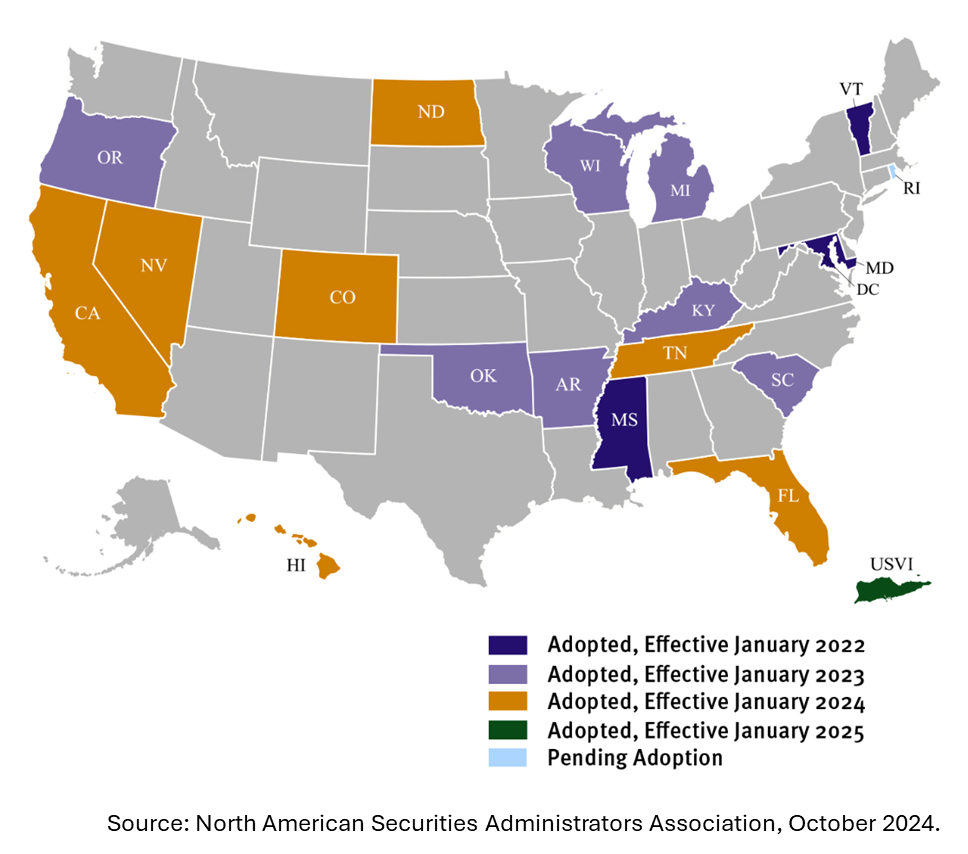

NASAA published model IAR CE rules in November 2020 and its model is effective in 22 states, as of January 2025, including California, Colorado, and Florida. Widespread adoption of IAR CE rules is a huge victory for financial consumers. Requiring Investment Adviser Representatives (IARs) to earn

Earning IAR CE For Fritz Meyer's Financial Economics Classes

If you are a regular attendee of Fritz Meyer's webinars and need IAR CE credits, successfully completing the IAR CE version of the live webinar is an excellent solution.

Fritz Meyer's webinars, delivered in a text based format meeting IAR CE requirements, earns 1.5 IAR CE credits. It requires reading the class transcript and slides and scoring a grade of 70% or more on a 15-question multiple-choice exam, but that's an efficient way to use of time to meet IAR CE requirements. As previously reported, NASAA is upping the bar on advisor CE by stiffening stan

IAR CE For State Registered Investment Advisors

A4A was recently approved as a CE/CPE provider by the North American Securities Administrators Association (NASAA), and IAR CE for state registered Investment Advisors is coming soon to Advisors4Advisors. A4A is in the process of submitting classes for approval. The process is rigorous.

Not only is A4A required to submit an application for approval of the content of every class, but instructors also must be approved. In addition, NASAA requirements prohibit active solicitation of a service or solution before, during, or after a CE/CPE class. NASAA-approved CE/CPE classes

Frank Murtha's Financial Counseling Course Addresses Bear Market Psychology

On June 13, 2022, when the S&P 500 index dropped more than 20% from its January 3 all-time closing high, a bear market began. This 1-credit class “Bear Markets And Financial Psychology,” provides practical ideas for counseling clients on the sudden loss of wealth experienced in recent weeks.

This class reviews the psychological effects of a bear market on investors. The objective is to better equip attendees with counseling strategies and skills in advising clients during this period of risk, fear, and opportunity.

&

2022 Estate Planning, 4-Credit CE/CPE Course

To earn a living giving estate tax advice requires much more than memorizing federal tax rules and regulations. It takes an understanding of how the rules work in different situations in a changing financial environment.

This four-class annual course is designed exclusively for Advisors4Advisors by L. Paul Hood, Jr., J.D., LL.M. to train CFP®, CPA and other financial professionals perpetually in strategic estate tax planning.

Samples of this elective course and client advice topics are free.

Subcategories

-

Webinar Replays

- Article Count:

- 1098

-

Webinar Replays

- Article Count:

- 1086