IAR CE For State Registered Investment Advisors Hot

A4A was recently approved as a CE/CPE provider by the North American Securities Administrators Association (NASAA), and IAR CE for state registered Investment Advisors is coming soon to Advisors4Advisors. A4A is in the process of submitting classes for approval. The process is rigorous.

Not only is A4A required to submit an application for approval of the content of every class, but instructors also must be approved. In addition, NASAA requirements prohibit active solicitation of a service or solution before, during, or after a CE/CPE class. NASAA-approved CE/CPE classes and instructors must disclose any conflicts of interest when applying for approval by NASAA and offer a plan to mitigate any conflicts. Actively soliciting class participants to buy a financial product, technolgy solution, or service is verboten. Not only is the solicitation of class attendees for any purpose other CE/CPE, but providers are not permitted to use the list of attendees to solicit them in a follow up email or phone marketing campaign.

Not only is A4A required to submit an application for approval of the content of every class, but instructors also must be approved. In addition, NASAA requirements prohibit active solicitation of a service or solution before, during, or after a CE/CPE class. NASAA-approved CE/CPE classes and instructors must disclose any conflicts of interest when applying for approval by NASAA and offer a plan to mitigate any conflicts. Actively soliciting class participants to buy a financial product, technolgy solution, or service is verboten. Not only is the solicitation of class attendees for any purpose other CE/CPE, but providers are not permitted to use the list of attendees to solicit them in a follow up email or phone marketing campaign.

NASAA is a powerful group and its entrance into regulating the education of financial professionals is a watershed in the evolution of the financial advice profession, which is comprised of CPA financial-planner, CFP, CIMA, CFA, and other credentialed professionals. Founded in 1919, NASAA is an association of state and provincial securities regulators in the U.S. and Canada. RIAs that manage less than $100 million, generally, are regulated by their home state, while RIAs with more than $100M in assets under management (AUM) are regulated by the federal government.

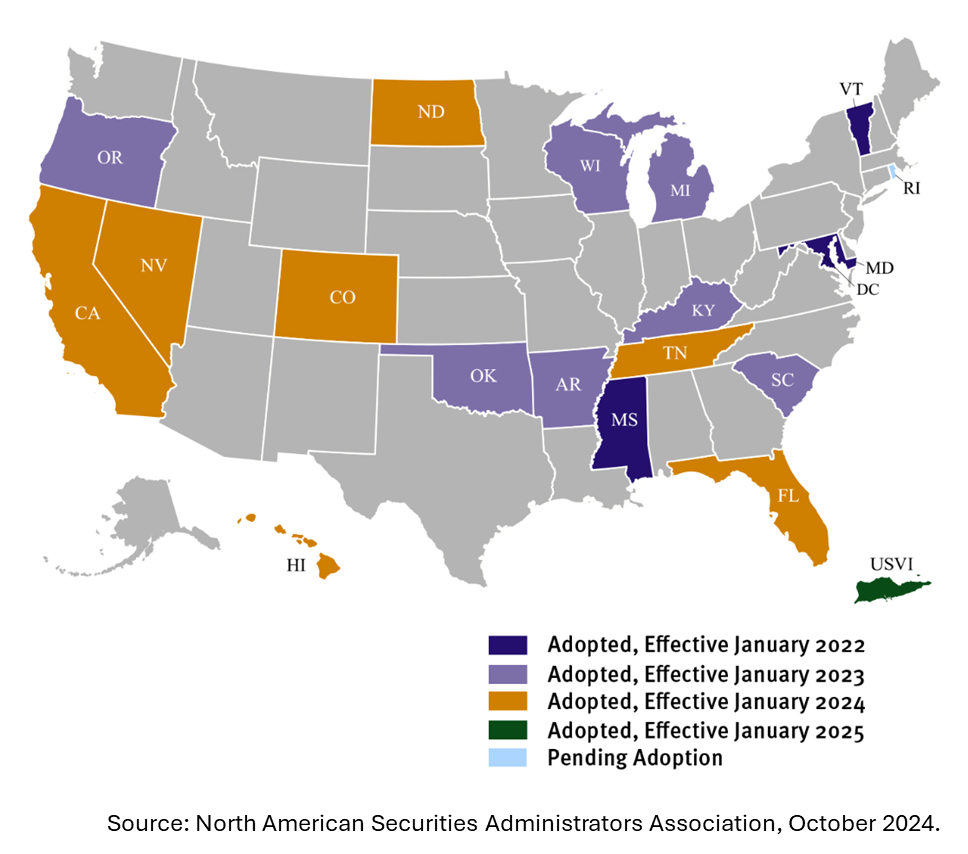

Since every state has its own laws for regulating RIAs and IARs, NASAA organizes the states by writing model law and rules that can be adopted by state legislatures as is or with modifications. The model rule for IAR CE was adopted by NASAA in 2020 and implemented by states beginning in 2022. So far, 18 states have adopted the IAR CE model rule, including California, Florida, and Tennessee.

Until now, anyone could pay a few hundred dollars for state or federal registration fees and create an RIA. No exam, experience or competency is required to get into the RIA business. NASAA's model rule requires IARs to complete 12 CE/CPE credits annually and pass an assessment of each class. Specically, six credits of classes about ethics and six credits about products or practices of professionals are required. To CFPs who must complete 30 credits of CE every two years, or CPA financial planners, who must complete 40 credits of CPE annually, the IAR CE requirement may seem easy to fulfill. But it is enough to keep fraudsters and unserious individuals out of the IAR field.

NASAA's IAR CE requirements affect only a small segment of the IAR population but it is likely to set a new standard for financial advice professionals.