IAR CE For State-Registered Advisers FAQ

Unlike CE/CPE for CFPs and CPAs, earning IAR CE credit requires passing an exam after attending a webinar and meeting NASAA's other requirements. A4A must write 15 questions for a 10-question multiple choice exam, enable you to securely submit your answers, score your answers and assign you a grade, and uploads successful completion data after each class to FINRA’s CRD database. NASAA charges A4A $3 to upload a record showing how many credits you've earned. A4A membership covers CFP, CIMA, and CPA credit and you get a discount on the cost of IAR CE.

Continue attending Fritz Meyer’s webinars to earn CFP Board, IWI, and NASBA CPA CPE for attending webinars. However, earning IAR CE credit requires reading Fritz's monthly remarks and charts, graphs and other slides and passing a 15-question multiple-choice test. The text-based version of Fritz's classes are expected to qualify for 1.5 credits of IAR CE. Making FRitz's webinars a text-based self-study course is the most cost effective use of your time.

NASAA, a century-old association for state securities regulators, coordinates IAR CE standards. NASAA's 2021 model rule for IAR CE upped the bar on advisors calling themselves a Registered Investment Adviser Representative. With 22 states implementing NASAA's IAR CE model rule as of January 2025, NASAA has created a significant barrier to calling yourself an IAR unless you're a serious professional. By setting education requirements on individuals who want to market themslves as investment adviser representatives (IARs), the number of fraudsters doing business as IARs is likely to be sharply reduced.

States that adopt NASAA's model rule are cleaning up a massive problem that has dogged advisor-consumer trust for decades: Anyone could call himself an investment advisor representative merelt by paying a licensing fee. You did not need to pass any tests of your professional abilities.

NASAA has upped the bar to entering the IAR business. To maintain a state IAR registration forces advisors to complete six ethics credit classes and six practice and product classes every calendar year. Moreover, NASAA does not allow IARs to earn credits by watching a webinar.

In contrast, CFP Board, IWI, and NASBA allow professionals to earn credit for merely attending a webinar for 50 minutes. NASAA's model rule requires IARs take a 10 question test to earn 1 credit on a 50- to 74-minute webinar. The test is scored, and the score measures whether you learned the objectives advertised in the course description.

To earn IAR CE on A4A for Fritz's classes, you’ll be required to download and read a transcript of Fritz's webinars, along with his charts, graphs, and slides containing his analysis, and then you must score 70% or more on a 15-question multiple choice assessment. By making Fritz's webinars a reading assigment, A4A is able to give you an extra half-credit for completing the class. That's because reading is a deeper learning experience than watching a webinar and each of Fritz's monthly classes.

Within three business days of Fritz Meyer's llve webinars every month, A4A expects to post Fritz's webinars as a IAR CE self-study version. However, the November IAR CE self-study versoin of Fritz Meyer's class may be delayed because it is the first submission by A4A to NASAA. Pre-order Fritz Meyer's November class for IAR CE credit.

,

Delivering Fritz Meyer's financial economics class by meeting NASAA self-study requirements for text-based material provides a deeper learning experience. Reading -- stopping to comprehend -- let's you learn at your own pace, while a live webinar is at the pace set by the instructor. In fact, NASAA does not provide IAR CE credit for merely watching a webinar. NASAA’s different from CE/CPE standards set by CFP Board, NASBA and IWI. NASAA requires webinar attendees to participate in an engagement exercise during the class and pass an assessment with a 70% or higher score.

| Pre-order |

NASAA’s requirement makes sense. Charts, tables, and other slides contain important data missed on a 60-minute webinar. Fritz Meyer's data and analysis are better absorbed by reading a printed page, smartphone, tablet, or device displaying interactive charts, so you can hover over a data point on a line chart. Absorbing the information at your own pace and the ability to mix media makes for a richer learning experience.

Unlike CFP Board, NASBA, and IWI, the North American Securities Administrators Association (NASAA) requires IARs to participate in an engagement activity, such as a poll, and score 70% or higher on a 15-question assessment to earn one credit.

A4A's IAR self-study classes are applying for 1½ credits instead of just one on a webinar. While you will have access to the webinar, your grade is based on reading the class materials and not watching a webinar.

Fritz Meyer's Financial Economics class on Advisors4Advisors is expected to be submitted every month for IAR CE self-study credit beginning with November's class.

It’s important to note that you cannot earn IAR CE credit for simply attending a webinar. In contrast to CFP Board, NASBA and IWI, NASAA requires webinar attendees pass an assessment.

Requiring advisors to pass a 15-question multiple-choice test based on a 60-minute live financial economics class led by Fritz Meyer is forcing learner to drink from a fire hose.

To receive IAR CE credit, you're required to read Fritz’s graphs, tables and other slides as well as a transcript of each class.

A4A has opted for the text-based self-study delivery method to meet NASAA"s requirements for IAR self study because it enables learners to stop and focus on what they don't understand or need to master. Moreover, the tax-based version earns 11/2 credits, as compared to the 1 credit on a 60-minute webinar and 15-question assessment.

IARs earn credit by completing a three-step process:

| Pre-order |

1. Download transcript, charts and other slides

2. Read content

3. Score at least 70% on a 20-question multiple-choice test.

Meeting NASAA self-study requirements for text-based reading enables a deeper learning experience than watching a webinar. You -- not the instructor -- control the pace of the class.

Fritz Meyer’s charts, tables, and other slides contain important information missing from a 60-minute webinar. Fritz Meyer's data and analysis are better absorbed on a printed page or a smartphone, tablet, or reading device displaying interactive charts and data.

No. Live and on-demand classes you participated in are not retroactively accorded IAR CE credit. For instance, if you participated in Fritz Meyer’s monthly class on October 23, 2024, you cannot receive IAR CE credit retroactively. Only classes submitted and approved by NASAA for review are eligible for IAR CE credit.

Established in 1919, the North American Securities Administrators Association (NASAA) is an association for state and provincial securities regulators in the United States, Canada, and Mexico. NASAA members are state government regulators charged with protecting investors from fraud and abuse. NASAA writes “model” laws and regulations often adopted by states to regulate financial services. NASAA’s Model Rule on Investment Adviser Representative Continuing Education was adopted by NASAA in November 2020 and is effective in 21 states, as of January 2025. The model IAR CE rule mandates investment advisers earn 12 CE credits every calendar year, with six about products and practice and six about ethics.

The first step is adding “IAR CE” to your A4A Profile. After editing your A4A Profile to include your Central Registration Depository (CRD) number. That makes you eligible to receive an IAR CE Self-Study Course Completion Certificate by successfully completing the required exercises and scoring at least 70% on an assessment.

A4A is required to submit IAR CE course completion records on your behalf to the FINRA-maintained CRD system within 30 daysof each eligible class.A4A pays NASAA’s $3 recordkeeping fee for each CE credit submittedto FINRA-maintained Investment Adviser CRD system.

After you attend a live class and participatein an unscored engagement exercise, such as a poll, you are eligible for IAR CE credit. No scored assessment is requiredto earn IAR CE credit.

After a live class, a recording of the class is made available. However, credit is earned by reading atranscript or article, engaging in an unscored exercise, and scoring 70% or better on a browser-based assessment. Playing back the webinarrecording will not earn self-study IAR CE credit; the recordings are provided to support the written word you can read on a smartphone or other reading device. However, the recordings support your preferred method for learning.

If you score less than 70% on the assessment three times, you’llbe required to re-register and repeat the entire course content-download, reading, exercise, and assessment process.

CE FAQs

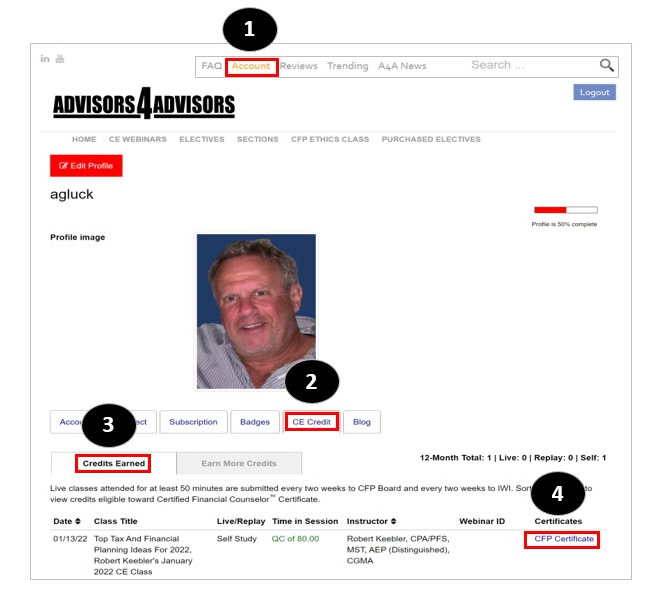

Start by making sure you have filled in your profile with your credentials. Without the license or ID number associated with your credentials, you will not receive a certificate of attendance. Here’s how to add a designation(s) to your A4A profile.

A4A organizes advisor CE activities in two reports: credits earned in the past 12 months and classes you can replay on-demand anytime to earn more credits.

The new reports save you time and money on CE and will help improve your CE habits. They help ensure you take full advantage of A4A's knowledge stream curated for fiduciaries -- member-sponsored CE from Bob Keebler, Fritz Meyer, Craig Israelsen, Frank Murtha and other thought leaders.

CPA CPE credit is only available from attending live A4A webinars. Please refer to the Webinars tab to see which upcoming sessions are eligible for live CPA CPE credit.

When attending the live webinar, you must remain in the session for at least 50 minutes and answer the 3 polling questions.

For sessions listed as eligible for 2 CPA CPE credits, you must remain in the session for at least 100 minutes and answer the 6 polling questions.

CPA CPE credit is only available from attending live A4A webinars.

First check the session's event listing to confirm that it is either eligible or pending eligibility for the CE credit you're seeking to obtain.

CFPs, IMCA designees and EAs must all remain in the live session for at least 50 minutes. However, EAs must also answer the 3 polling questions launched during the live session.

Enter your CFP ID, IMCA ID or PTIN in the exit-survey. We report live webinar attendance for CFPs, IMCA designees and EAs.

To learn how to receive continuing professional education credit viewing webinar replays, please see our detailed instructions.

If you do not see your GoToWebinar registration confirmation, please double-check your email spam/junk folders. The emails come fromcustomercare@gotowebinar.com. If you still cannot find the email, please contact us right away.

We stopped doing it in 2012 because no one wants another daily email.

We send a weekly digest and invitations to webinars.

Sign up to receive it and make sure it does not go into your junk or clutter

Fritz Meyer's monthly PowerPoint presentations are available for just $600 a year — to A4A members. You can use them to create newsletters, blog posts, videos, articles, and presentations. Brand them with your logo, but be sure please to source it to Fritz Meyer Economics.

Robert Keebler's tax analysis PowerPoint presentations are available for just $600 a year — to A4A members. You can use them to create newsletters, blog posts, videos, articles, and presentations. Brand them with your logo, but be sure please to source it to Keebler Tax & Wealth Education.

Craig Israelsen's asset allocation PowerPoint presentations are available for $600 a year. You can use them to create newsletters, blog posts, videos, articles, and presentations. Brand them with your logo, but be sure please to source it to 7Twelve® Portfolio.

The slides are only available for download at downloads.advisorproducts.com. Or, if you subscribed within the last few months, the slides plus the newly offered webinar transcripts are available for download in your dashboard at www.AdvisorProducts.com.

You should have received your user name and password via email when you first subscribed. If you've forgotten your username or password, please click on the Forgot your password? Forgot your username? links as appropriate.

We submit the completed CFP certificants' Ethics CE credit to the CFP Board in monthly batches. Once the CFP Board has processed your Ethics CE credit, you will receive an email from the CFP Board detailing the continuing education hours that have been credited to your CFP account.

Upon your purchase of the A4A Ethics course, you should have received a system email with the subject: "Advisors4Advisors - Thank you for purchasing our 2016 CFP Ethics CE course for A4A members.", which contains the unique link to access the Ethics course.

CIMA® designees report programs accepted for CE credit online via your own IWI account, using the approval letter that will appear in your A4A Account's CE Credit tab upon successful of the Ethics test. The A4A approval letter is the certificate of completion and already contains the unique IWI-assigned program ID number, so IWI designees can report the program online with ease. Please remember that designees must maintain physical evidence of completing CE programs in the event they are selected for audit.

Until now, you did not need to know anything about the psychology of financial planning to be a CFP® professional. Effective Jan. 1, 2022. however, the psychology of financial planning will comprise seven percent of what you must know to hold a CFP® designation. Ahead of the CFP Board action, A4A added psychology of financial advice topics to its core curriculum to fill a gap between traditional knowledge topics financial professionals are required to master and current requirements. To be clear, a completely new topic, the psychology of financial planning, is being added to CFP Board knowledge requirements, and A4A designed this course ahead of this crucial new trend.

A4A strives to be the most efficient way for a fiduciary to always stay current on what you need to know to run a professional financial services firm ethically -- just the facts you need to know about investment, tax, and financial planning with no commercial influence in a single website, on-demand 24/7. Spurred by the burgeoning social science of behavioral economics for the past two decades, the nature of client relationships has grown more personal, collaborative, and individualized, requiring today’s professionals to possess investor personality counseling skills. That’s why A4A added psychology of financial advice topics to its core curriculum.

Certified Financial Counselor™ (CFC™) FAQs

To display a list of additional classes needed to complete the 12-credit Certified Financial Counselor™ course and certificate CE program:

- Sign into your A4A account

- Click on Account at the top to open your A4A account profile.

- Click on CE Credit tab

- Click on Earn More Credits

- Sort the list by clicking on Instructor

- Scroll down to Instructor Frank Murtha to see which CFC™ classes you need to complete the 12-credit course

If you successfully completed the 12 class CFC™ certificate course, your certificate of completion can be displayed on websites, email-newsletters, and anyplace else using any HTML editor.

Instructions are in the two-minute below and outlined step-by-step in this PDF with screenshots.

Digital certificates are like SSL (secure socket layer) certificates on websites. Financial advisor professional accreditation organizations, such as the AICPA, CFA Institute and CFP Board are already issuing digital certificates to authenticate professionals. The digital certificate image is encrypted and validated by the Financial Counseling Institute (FCI).

Digital certificates are like SSL (secure socket layer) certificates on websites. Financial advisor professional accreditation organizations, such as the AICPA, CFA Institute and CFP Board are already issuing digital certificates to authenticate professionals. The digital certificate image is encrypted and validated by the Financial Counseling Institute (FCI).

CFP Board, AICPA, and CFA Institute, all mint digital badges to validate their respective credential holders. The use of digital badges transforms branding for practitioners and clears up consumer confusion.

According to FINRA’s database, the number of financial professional designations has swelled to more than 200! For financial consumers, it's confusing and nightmarish. Designation proliferation raises a fundamental question for consumers: How do you know whether to trust an advisor?

A digitally validated badge on your website, social profiles, and emails clears up confusion for consumers. Powered by A4A, the digtital badge that comes with maintaining a Certified Financial Counselor™ (CFC™) certificate puts professionals at the forefront of the trend toward digital specilization certificates for CFP®, CPA®, CFA®, CIMA®, and other financial professionals.

Pay-to-play five-star advisor badges are not based on rigorous research or objective data. In contrast, a digital badge earned by attending the 12-class program and two classes annually, demonstrates that you have done the hard work to maintain a CFC™ designation.

Of the four comprehensive designations earned by financial advisors, the CPA and CFA® designations have been around longest. AICPA was founded in 1887 and CFAs® were first chartered in 1962. These two senior certifying bodies are integrated into the U.S. regulatory system.

Founded in the mid-1980s, Investment Wealth Institute and CFP Board are relative newcomers as accreditation bodies. CFP Board certifies more than 92,000 practitioners, compared to about 10,000 IWI accredited professionals. CFP Board has also outflanked the AICPA. CFP® is the predominant financial planner designation known to financial consumers. CFP Board extended its consumer brand recognition over other acceditation bodies by investing in a years-long advertising campaign on national TV.

Attending the 12-credit Financial Counseling course, which is available on-demand, earns a CPA, CFA®, CFP® and CIMA® professional license to display the Certified Financial Counselor™ badge on a website home page, social network profile and email signature.

Within the past 12 months, if you have successfully completed, “Applying Financial Psychology In Current Conditions, download your Certified Financial Counselor™ digital certificate badge by:

1. Logging into Advisors4Advisors.com

2. Clicking the red “Edit Profile” button

3. Clicking “Copy Script” and choose the size of the certificate needed

The 12-class Certified Financial Counselor™ Certificate Course was free to A4A members through December 31, 2021.

On January 1, 2022, the course became an optional elective.

If you successfully completed the initial 12-class course in 2021, renew your CFC™ designation here.

If you did not complete the inaugural 12-classes in 2021, sign up here.

Applied Financial Psychology In Current Conditions may be attended live or replayed anytime on-demand. If you take the live class, you must complete three polls administered during the class. If you replay the class, to receive CE credit, you must complete a 10-question quiz at the end of the replay and answer at least seven of the 10 multiple-choice questions correctly.

“Applying Financial Psychology In Current Conditions,” which must be completed annually to maintain the Investor Behavioral Coach certificate, is taught every six months.

A4A Membership FAQs

Refunds requested 10 days or less from signing up for A4A membership are issued unconditionally. All sales of classes purchased a la carte are final. Please send refund requests to admin@advisors4advisors.com.

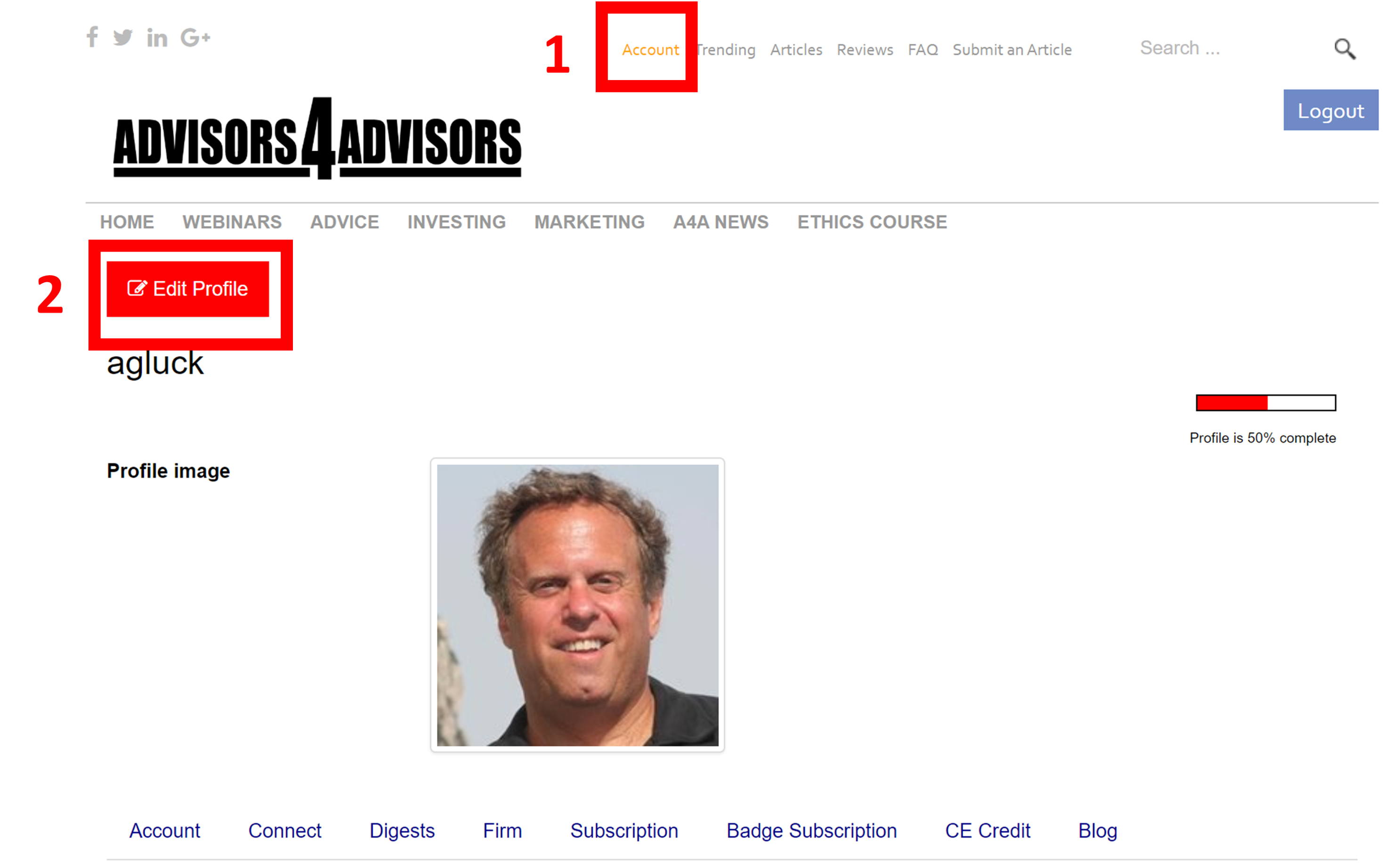

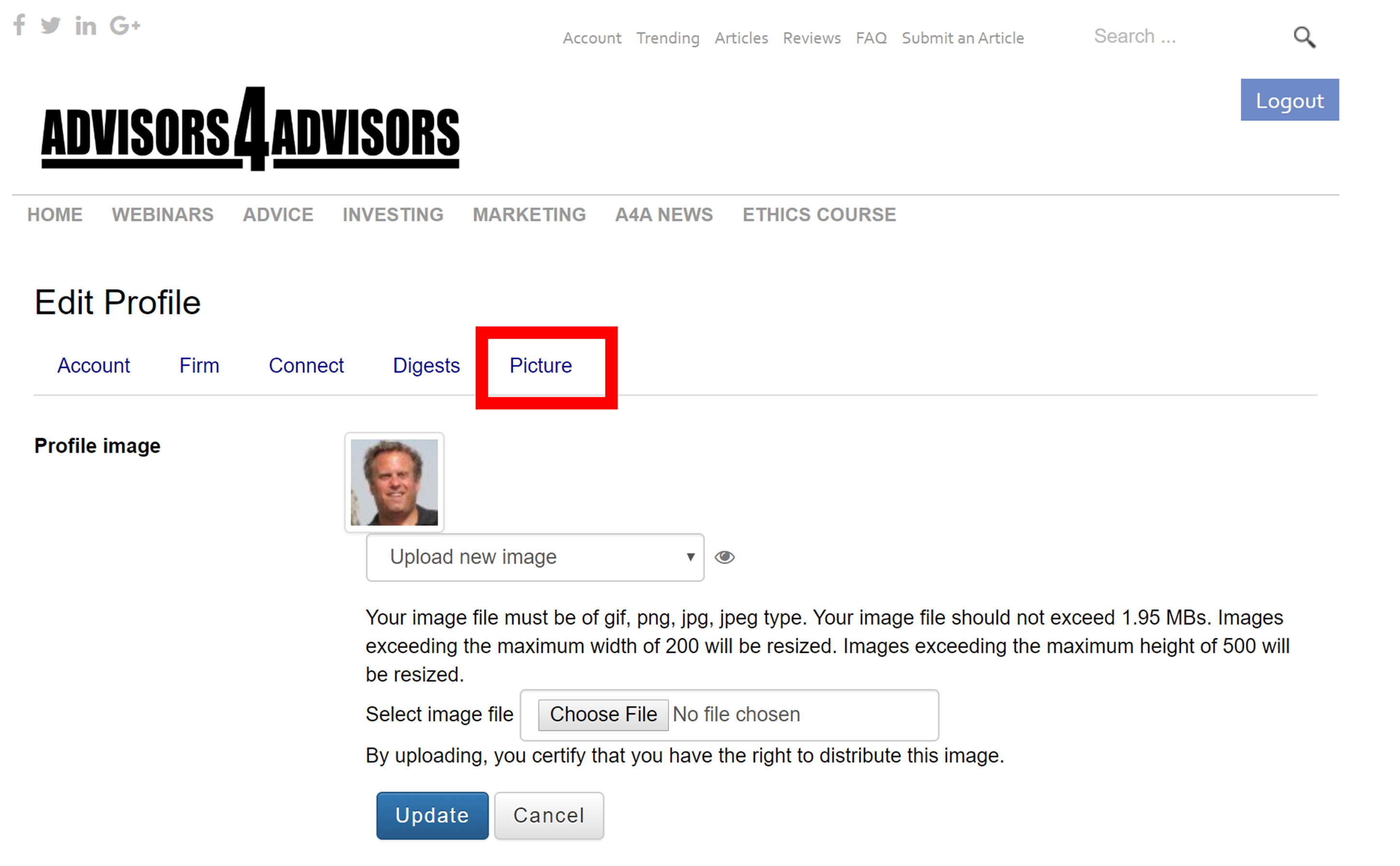

Click Account, and then Edit Profile.

Then click Picture and upload a new image from your local drive.

See the two images below.

Log-in to your existing account on Advisors4Advisors.com.

***At the top, click Account.

Click the red Edit Profile button towards the top-left.

Scroll down and, for example, fill in your CFP ID into both of the ID field. Then click the red add button to locate your professional designation.

Select your professional designation and then fill in the ID number into the field that will appear below the list.

Click ‘Update’ at the bottom to save your professional designation(s) ID number(s).

Sign up to receive our emails.

If you don't receive an email thanking you for subscribing in a few minutes, it's probably in your Junk or Clutter folder.

If not, please open a ticket.

Click here to sign-up for Advisors4Advisors.

Unlimited free continuing education credit available 24/7 on most sessions from the CFP Board of Standards and the Investment Wealth Institute, PACE credit toward CLU® and ChFC® designations, as well as IRS Continuing Education credits for Enrolled Agents.

CPAs are eligible to receive continuing professional education credit for attending live sessions but not replays.

|

A4A MEMBERSHIP BENEFITS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please email us at admin@advisors4advisors.com letting us know.

The quiz will only show up in your A4A profile's CE Credit tab if you view the replay for an uninterrupted 50 minutes for a session approved for one credit hour or 100 minutes for a session approved for two CE credit hours, without adjusting the time ticker. You cannot pause, rewind, or fast forward the replay.

If the session is listed as pending CE credit, the CE quiz will not yet be accessible.

There are two steps to complete within your PayPal account.

1. Log in to the PayPal account used to create the subscription and add a new funding source.

2. Click on the 'Profile' subtab.

3. Choose the 'Credit Cards' link from the Financial Information column.

4. Click 'Add'.

1. Click this link to access your A4A Subscription Details: http://bit.ly/2gCwgqc.

2. Under 'Subscription Funding Source' choose your new funding source from one of the drop-downs and save.

A4A members must contact us by phone at 516-333-0066 x219 to request a change to their subscription billing information. This is because of the way that VISA handles the security. For security purposes, the card details are stored in the VISA cloud (not our server). We are then constrained by the way that the VISA system allows these changes, and for subscriptions, the consumer can not make these changes proactively.