Advisors On The Move Need Financial Planning More Than Anyone Hot

There’s a real sense in the wirehouses right now that with top-line transition packages trending at above 3 years production at the very high end, this is a chance in a lifetime for every advisor to call a recruiter, take the check, and retire three years early.

If those advisors were their own clients, we’d call that a case of letting short-term emotion -- pure greed -- interfere with long-term rationality.

Don’t get me wrong. I’m a real supporter of every advisor taking his or her talents to a business environment that rewards those talents to the fullest and supports a culture where that advisor and the clients can flourish.

If that environment is not where an advisor happens to be right now, he or she needs to move. It’s that simple, and a lot of my business is based on that principle. But too often, the move becomes all about chasing that transition check. That’s where a lot of advisors are getting into trouble.

For one thing, only the wirehouses are offering the really huge cash packages right now, which is why you mostly see firms like Morgan Stanley and UBS hiring from each other. In these moves, the only thing that really changes for the advisor is the business cards, but at least he or she’s gotten the chance to cash in, right?

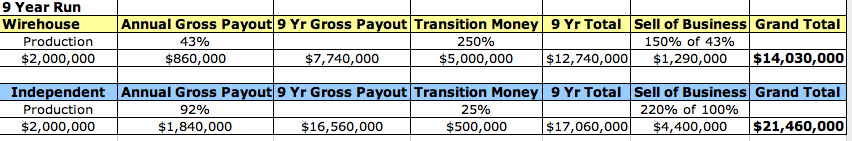

The rep who moves from wirehouse to wirehouse is still an employee and still giving the firm maybe 60% of all the fees and commissions that come in. Going independent brings a whole new set of challenges and opportunities, but at the end of the day the signing check is smaller and the advisor only has to pass on maybe 15% of production.

Say you’re a 55-year-old advisor bringing down $2 million a year for the wirehouse. UBS wants to give you 250% of that production as a signing bonus. One of the independents can scrape up a package worth 25% of your production. Given one check for $5 million and another for $500,000, which do you take?

If you were your own client, you’d tell yourself to do the math and see what makes sense.

It’s a very simplified comparison, but it gets advisors I talk to thinking beyond instant gratification and focused on how today’s decisions amortize over the course of an entire career.

And like these advisors always tell their clients, the younger you can start thinking seriously about these issues, the more years you have to let today’s decisions pay off.