Top Stories

Free Trial Of Groundbreaking Financial Counseling CE Course & Certification

- Details

- Written by Andrew Gluck

- Category: A4A News

Here's a free trial of a groundbreaking 12-credit Financial Counseling CE course led by Frank Murtha, Ph.D. The first class, entitled, “Financial Counseling: An Introduction And Overview,” received a rating of 9.4 (out 10) from attendees. The transcript (below) and video of this are a no-risk way for non-members to see the first class. The remaining 11 classes are free with A4A membership ($60 quarterly for 48+ CE credits). If you are already an A4A member, log in for CE credit.

Class 2 is Wednesday, July 14 at 4 p.m. ET. Starting with the live broadcast of Class 3 on Wednesday, July 28 at 4, classes will be held every Wednesday through September 29, 2021. Successfully completing all 12 classes earns a Certified Financial Counselor™ designation. For details, read the 12-credit CE course curriculum and FAQ.

A transcript of Dr. Frank Murtha's first class follows:

Let me just start by saying that it's been a pleasure to work with you, as well. I've really been impressed by A4A and the stable of thought leaders that you've got there, and I'm pleased to be included among them. I think it's wonderful. And yes, this is new content. We are breaking some new ground here. The name of this course is Financial Counseling. There’s going to be 12 sessions, but this first one is going to serve as a bit of an introduction and an overview. We're going to be 50 minutes, with 10 minutes for Q&A, and I believe you will find it interesting, engaging, and possibly even a little bit fun.

Well, please allow me to introduce myself. Andy did a very good job of that, but one thing that I would like to emphasize is that I really did come to this field via a very different route than I imagine most of you have. I am indeed trained as a counseling psychologist, but one day, in the lab at the University of Buffalo in the late ’90s, I made a discovery, and this discovery changed my life forever. I discovered that, unlike my colleagues in the counseling psychology program, I really didn't like working with people who had emotional issues. It's OK to chuckle. You may appreciate the irony there. Yeah. The best thing I can compare it to, folks, if you’ve ever been driving on a highway and you kind of think you missed your exit but you're not 100% sure, well, you got two choices. You can either bang a U-turn, go back and find that exit you're pretty sure you missed, or you keep driving and you get off at the next exit. So, I kept driving. I said to myself, “Look, I want to be a psychologist. I want to help people with their problems. But, boy, these emotional people, they're very draining and challenging to work with. I need to find a more rational population, people who don't let emotions overtake them so much.” So, now I work with stock market investors, and you may be able to appreciate the irony of my career path because there is nothing more emotional and less rational than the relationship people have to their money. And I'll tell you, I have made another discovery over the years, and it's this: You and I, we're really in the same business. I mean, for one thing, as a psychologist, my job was to try and help people live their best lives, to help them do that by overcoming anxiety and depression and discouragement, so that they could fulfill their lives here on Earth. Well, that's what you're doing. That's what you're doing. You're helping people acquire the resources necessary to live lives without anxiety and depression, and get the best out of this world. Let me start by saying what you do is extremely important. There is a mountain of data that I could point to, the size of Everest, that shows people left to their own devices are going to make a hash out of their investing over the long term, and fail to reach their goals. So, with that being said, let's take a look forward, and let's explore the similarities and take a look at financial counseling.

But before we do that, let me just say I truly believe that your profession is under attack from a lot of different angles.

For one thing, there's legislation out there. There are people seeking to make it more difficult to do your job—a lack of trust, an increase of regulations. We may have dodged some, but there's always more coming, and the threat looms.

In addition, there has been, in my mind, a real misunderstanding in a movement towards passive investing. Here's a quotation. It's typical. It says, over the past 30 years, the S&P has returned x, but by comparison, individual investors only got y over the same time, and “the numbers don't lie. As it turns out, just simply investing in the market would have been a better bet than following the advice of an investment advisor.” OK, where to begin? This isn't true, and it's not true because people leave out one small factor—human nature. Sure, investing passively makes sense on paper. Just buy a bunch of ETFs, leave them alone, put all your money in that, don't look at it. You'll be fine. All right? But it leads to some very important investment myths, which I think have done a great disservice to the investing community.

I’ve made a catalog of these myths. Here’s one. I call it “The Index Investing Unicorn.” He averages 10% market returns and outperforms 90% of his peers just by buying and holding index funds for the long term. I don't know. I mean, certainly there are people who do this. There are successful investors who have gone this route. It makes sense, again, on paper, but we don't live on paper. We live in a three-dimensional world with things like emotions and problems, right? And so, I mean, I suppose there are folks out there who have the insights of Warren Buffett and the serenity of Gandhi, and they can basically leave their money alone and not worry about it and invest optimally, but I don't know a lot of people like that. And here's the problem: It sends a message to the investing community, perhaps even your clients, that investing is easy. Remember the old TD Ameritrade commercials with Stewart the office slacker, and how Stewart was crushing the market and he was blowing everybody away with his returns? There's also another ad campaign which was funny, about a baby investing from his crib. The message is always, “You got this. This is simple.” Well, it may be simple, but it's not easy. I like to think of this in terms, a little bit, of an analogy of getting in physical shape. We talk about wanting to get our finances in shape, but what about getting in physical shape? I can tell you, I have two kids. I got a 12-year-old and a 9-year-old. And if I ask my 9-year-old daughter, “Hey, what's the secret to getting in good shape?” she will tell me—you can say it with me, if you want, at home—“It is eat right and exercise.” That’s it. My 9-year-old knows this. So, being as everybody knows what to do, and it's so simple, how come we live in the most overweight country in the history of the world? Clearly, there is a disconnect here. People refer to obesity as an epidemic, and yet there's an easy prescription which everybody knows, supposedly. Look, here's what we do know. Knowing the right thing to do is not sufficient for success. If it were, kids would eat their vegetables, teenagers wouldn't vape, and we’d live in a country of millionaires with 5 percent body fat. And that's not the world we live in. Investing is challenging. People are going to need folks like you to help them through this process.

Then there's the robo-advisors. They can do it faster, deeper. Robinhood. Boy, I can tell you, I experienced mixed emotions when I saw what happened over there at Robinhood. I mean, on one hand, you hate to see people lose money. On the other hand, caveat emptor, right? Buyer beware, right? So, there’s all kinds of things right now that are making it challenging for somebody to be a financial advisor, a lot of voices out there whispering that it's not worth it. Those voices are wrong. And what I hope to do is provide some weaponry—some defense, if you want to go more pacifistic—against these attacks.

All right, let's talk a little bit about the evolution of the financial advising profession, such as it is. I don’t know about you. We've got some folks here who I imagine are old enough to remember the field when somebody would call on the phone. I remember we got them at our house. Our broker, our guy, would call us on the phone. They’d talk to my mom or my dad, usually my dad, and try and convince him to invest in certain things. And sometimes my dad would go along. Other times, he wouldn’t. That was the stockbroker transactional model, sales-oriented. But things changed. They evolved. We moved towards an expert model—financial advisor. It’s right there in the term, right? This is a person who is an expert. They give advice. They essentially help people make those better decisions. But it's a little bit more of a one-way street. I think that this is still probably considered the dominant model out there, but we're still evolving. Right now, the way the field is moving—financial counselor. Somebody who is more collaborative with clients. Somebody who is more holistic with clients, and more personal with clients. And that's why we wanted to create this material. Because, to my way of thinking, there's a bit of a gap from the training people need to do the job and—you can do the job—but the training needed to really thrive in it and do well on the cutting edge, and where this field is going. There’s a bit of a disconnect. And I'll tell you something else. That's where the value is. The value is going to be in a financial counseling manner because, let's face it, the information is out there now. Everybody knows about ETFs, Robinhood. There are people who are trading and investing with the push of a button, walking down the street. We need ways to distinguish ourselves and make our value plain. And the fact of matter is, where I think you guys do the Lord's work is by this collaborative, behavioral, psychological side of things.

Here we have a not-to-scale pie chart, which is put out by CFP. And I’m very glad to see that they recognize this trend. You’ll notice H, somewhere around 11 o'clock on your dial. Psychology of Financial Planning is there. It represents 7% of the material that will be necessary for next year. I consider this a really good sign, and I invite you to consider it a good sign too. Not just an extra burden, but a true opportunity for you guys to make a difference in the lives of your clients and build your business. We’ll talk a little bit more about that, but I was very pleased. We are definitely on the right side of a trend gathering steam here.

So, why financial counseling? What do I hope it is? What do I expect it is that you're going to get out of this? Well, for one thing, these skills and this knowledge base will help you better serve your clients. We’re talking about happier clients, more satisfied clients, clients who want to make referrals. But also, although I would never guarantee this, because I’m not a fool, I believe if you follow these principles, you will actually get better performance for your clients. Because when your clients are invested in positions that are a good fit for who they are, because you have that understanding and that relationship and are able to communicate, they’re naturally going to get better performance. And let’s face it, all too many clients think that that's the be all and end all. So, this is really meant to help you better serve your client, both in the statements and just making them have happier lives. And secondly, improving you business. I mean, I've been in this business for 20 years now, and one of the first things that I was taught was WIIFM—“What's in it for me?” Well, I want you to know that what is in it is improvements to your business, improved relationships, more efficient use of your time, greater wallet share, better condition of prospects. That's where I'm going with this, and I do not want to take my eye off the ball to take a look at fun, fancy theories that are interesting but aren't going to help you improve your business and improve the lives of your family.Lastly, to distinguish yourself professionally. As I mentioned, it’s been 20 years in this business for me—long time now—and without fail, if I ask a financial advisor or a financial planner, I’ll say, “Hey, what’s your philosophy? How do you approach your clients?” and I will always get some version of this: “Well I get to know you, who you are, and I customize a plan built around your needs and your personal financial goals. We put that plan in action, and that's what I do.” And that's great. I mean, that's exactly what I would expect. I think that's the way to go. The only issue is, I've never met a financial advisor who doesn't say that. Everybody talks this talk. That’s what prospects hear. That's what the general public hears. But what can you do to walk that walk? What can you do to show people, look, a lot of people pay this lip service, but here's a skill set that I've developed because I know that's what's important. And that's how I can make sure that I'm really living up to these things, and not just saying what every other person is going to tell you at a cocktail party. So, that's my reasoning behind this.

So, there’s a field and, frankly, a ship on which I sailed under the flag of behavioral finance for many years. Behavioral finance is essentially … Well, I used to call it financial psychology, but it doesn't go quite far enough. And that's why we're taking this to another level, which is a little bit even more on the cutting edge. Behavioral finance—I imagine most of you are aware of it—it really revolutionized the industry, because what it proved is that traditional economics and financial principles were based on inaccuracies, on false assumptions of human nature, which is a stubborn thing. Perhaps the godfather of behavioral finance, Daniel Kahneman. There’s Daniel Kahneman right there. There he is receiving the Nobel Prize. This is him receiving the Presidential Medal of Freedom. He’s a psychologist, by the way. He’s not even an economist, but he won the Nobel Prize for economics. He proved that reality is greater and more important and different than theory. He talked about prospect theory, basically showing that when we think people are being rational and self-interested, in fact, they are treating their money very, very differently, based on psychological states. And he really paved the way for this entire field called behavioral finance, which has been a really important innovation in the investing world for 30 years now. And again, I'm assuming a certain amount of familiarity because, I mean, I was talking about behavioral finance back in 2001. I mean, I was country before country was cool, and nobody knew what I was talking about. But now I get the sense everybody’s familiar with it. The focus has always been on irrationality, on biases, these little mistakes that people make. In fact, they have a catalog of mistakes. I've seen literature produced that cataloged dozens and dozens of these little quirky mistakes that people make. But there is, I think, legitimate criticism of behavioral finance, and it’s basically this. What this field did a great job of doing, we're saying we now understand and recognize all the ways investors behave irrationally, and all the things they do that hurt themselves. And now that we have identified all of this, knock it off [laughs]. That's pretty much what they said—“Yep, now we know.” But as we've already demonstrated, knowing what to do and changing behavior—two very different things. Which is where financial counseling comes into play.

Financial counseling operates in the arena of finance and investing. It draws off of behavioral finance. But it's also rooted in traditional psychology, particularly counseling psychology—time tested theory and practice that goes back decades. I mean, I don't know how many of you folks have a background in psychology. It was a very popular major back when I went to school, so a lot of you probably have some experience. But we're really going to borrow from some of the best and most important traditions of psychology, so if you decided to skip psych in college and opt for some other class, here's your chance to revisit that. Also, there's a focus on emotions. Biases, cognitions, the way we think, that’s important, but for me—and all of my experience tells me this—what really changes people's behavior is emotions. The head works great, but it's the gut that drives people. And we're going to focus more on understanding those emotions and coming up with ways that we can have an impact—change and manage people through emotions that get in the way of better investing and better lives. Financial counseling is designed to change behavior. The entire point of seeing a psychologist is to do things differently, to make changes for the better, and that's what this is designed to do. And then, lastly, this is designed to improve relationships. When you complete this course and you absorb the skills and the knowledge that we're going to cover here, it is going to lead to deeper, more caring, more solid relationships with your clients, which will have benefits in a lot of different ways.

Let's talk a little bit about a concept I call “advisor alpha.” Apparently, I wasn't the first person to think of this. There's some firm out there, a fund company, that uses this term. But when I say “advisor alpha,” I'm talking about the value proposition that you bring to your clients—the whole reason somebody would use you, hire you for your services. But let me start by saying I think that there must be some misunderstanding. I am convinced that the investing public, and perhaps even your clients, truly do not understand exactly what it is you do. I think that a lot of people look at you and think, “Oh, well, I guess he knows where to invest. He knows where the stock market’s going. Or she, for that matter, knows where the stock market is going to go next. They'll have a great understanding of how I can … If it were just me, maybe I'd get a bunt single. But if I outsource this to somebody who knows how to make money, well, then I know they’ll hit home runs for me, and I'll just sit back and pay them.” That’s not what financial advisors and financial planners do. It's much more akin to what a counselor does. But that is a misunderstanding, and that needs to be bridged, that gap, if we're going to help make clear the value proposition we bring. And as we can see, this is truly where the field is going, and it's becoming increasingly necessary to compete with the Robinhoods of the world. Now, very few things anger me more, when it comes to this field, than what I call the commoditization myth. The commoditization myth is not merely that a financial advisor doesn't add value. You do. It's that they're all the same. Financial advisors are all the same. It doesn't really matter. I mean, they're just going to put me in some cookie-cutter portfolio, ETFs. It doesn't matter whom I choose to be my financial advisor. That is nonsense, and it’s insulting. A financial advisor is not different from a doctor, or an attorney, or any professional who relies upon their expertise, their judgment, and their communication skills to improve the lives of their clients. But somehow, along the way, the field … I don’t want to say the field let this happen, because they fought against it, but this myth has taken hold. And we're going to bust that one wide open. I put a number down there. It's 4.83%. It refers to a study done by Russell Investments, a really cool study, actually—many of you, I'm sure, have read it—the Value of an Advisor Study. And what they determined is that people who use an advisor outperform those who do not by exactly 4.83%. I'm sure that number shifts around, but that's really it. And of course, they were also factoring in there's a 1% fee, typically. So, overall, 3.83%. That is a massive message that is not getting out, and I think it's because it’s swept up with these other misunderstandings. The reason they found, the biggest reason, why people outperform when they use an advisor is that advisors help people to manage the process. The process is more important than the content. The misunderstanding is, “Hey, I’ve just got to pick the right basket of stocks, the right fund, the right sector.” OK, sure. That's important. I don't want to diminish that. But what's really important is the process, and I'll give you an example. Because the fact of the matter is, there's a lot of right ways to get to the destination, but you got to be able to walk that road. I'm going to probably go back to one of my favorite analogies. Don't know if you’ve noticed this—I love analogies. I've loved them since I was a kid. I was an ADD kid, ADHD. My mind would hop all over the place. So, in order to make sense of the world, I learned to take things that seem a bit disconnected, connect them, and help me gather my thoughts. Here's an analogy. Basically, an investing plan is like a nutritional plan. It's like an eating plan. I don't want to call it a diet, because I'm currently on a nutritional plan and I hate telling people I'm on a diet. But we’re really talking about a diet. Now, if you wanted to go on a diet … And think of this for your clients, and think of this for your prospects, because this is a really effective way to get this message out. Go on Amazon, google books, google plans. You will find dozens of them, more than dozens of them. You’ll get tired after the first page. You’ll stop looking. There's so many of them. How do you choose? I mean, how do you pick one? And you want to know what complicates things? They all work. I mean, forget the quack diets, like you're just going to eat, I don't know, grapefruits and raw steak or something, and then that's going to be your plan. If you throw that stuff out, basically every diet plan works if you follow it. Ah, but here comes human nature again, right? Because the right plan for any investor is not a plan that would work if you follow it. It's the plan they can best follow. And that's where we come in. That's where we add the value. And that is a message and a skill set that I have dedicated the last 20 years of my life to making sure break through.

Now, I did not want to get too deep into content and techniques. This is meant to be an overview. But I'll talk a little bit about advisor alpha and a very important thing that we essentially need to do to add value for our clients. Essentially, all clients are stuck in what I would call an unproductive frame, and we want to help them reframe. That is, give them a different way of understanding the issue at hand—investing their money, accumulating wealth. The unproductive frame is focused on the market. And, man, let me tell you, I've been on CNBC, I've been on Fox News, Fox Business, NPR, all that stuff. And I enjoy it. I get a kick out of it. But there's really too much media. It does not do the investing public the favor they think they're doing, because it keeps people's focus on the market and benchmarks and things that are frankly unproductive. They’re focused on the money. That's not productive. Another problem is, it causes people to take a short-term view of investing. Now, I'm staying away from general behavioral finance principles because that’s something I think other people can cover in another class. But I will say that there is an investing bias called short-term thinking. And for my money, it is the most insidious bias out there. Short-term thinking causes more pain, and causes people to make worse decisions, than any other bias. And here's the thing about short term thinking—it is unconscious. We don't know we’re in a short-term framework. It is constant. I mean, it's always happening, at any given second. And then, lastly, it's immune to data. We still get drawn into these short-term narratives and short-term focus, even when our brain knows facts, facts that should help us pull it out. I like to think of this as like gravity. Presumably, you are listening, hopefully looking, at this presentation. I'm going to assume you're not lying on the floor, flopped over. That’s because you’re fighting against gravity. It takes a real effort to do that. You're not aware. Nobody’s thinking about it. But gravity is constantly here and it's constantly dragging us down. We have to fight against it. And it takes effort, even that we're not aware of. Same thing with short-term thinking. And we're going to learn some strategies to help pull people out and build some muscles that they can resist this. Basically, thinking short term is the price human beings pay for being human beings and being awake. And also, the “what.” People are always asking the question, the “what.” We're going to talk and learn about how to reframe to a much better question. So, what does a more productive frame look like? Big picture, what is it we're going to do with financial counseling that's going to help our clients move forward? First of all, we're going to focus on goals. The money? That's not what's important. What's important in the end is the goals, real life. Long term, we are going to broaden the perspective. It’s hugely important we do, because if people are in that short-term perspective, they are going to … Whew! It gets ugly quick. And when people are in a long term, it breaks them out of the emotions. Short-term perspectives, emotions rule. Long term, you can access some of the more rational parts of the human brain. You can help people exercise much better decisions.And then, lastly, the “why.” Much better question than the “what.” Why are we doing this? Why are we putting our money away? It's a wonderful way to reset. And when it comes to resetting with our clients and reframing, a lot of times it really starts with a good question. Here's an example. Let’s just talk about the “what.” What to invest in right now is certainly an important question, Mr. Client, but I'd like to talk about an even more important question that's just as relevant right now, which is, “Why?” Why are you putting your money away? Let's talk for a moment, if we may, not about the short term, not about what's happened in the past month, Trump's latest tweet, a Fed meeting. Let's not talk about that. Let's talk about the year 2031. How old will your children be that year? One of the reasons why this is so effective, you ask that question, it forces the brain to entertain this different question, and it snaps them right out. It's impossible to be focused on the short-term goings on of a market when you're asking somebody to think of their goals and think of what their future is going to look like in 10 years. And we have to find these ways to snap out of it. One of the things you’ll find over the course of this course is that a lot of it boils down to knowing how and when to ask the right questions. Those are the forks in the road.Let’s talk about some fundamental principles. I have spoken on this subject a lot, and I have come to the conclusion that this is probably the single most important slide in the presentation. If you take one thing away, let it be this: Making money is not the goal of investing. Now, some of you out there may be saying to yourselves, “Yeah, obviously. I mean, that's not the goal.” But I also know from experience that there are people out there who think I am crazy for suggesting that. “Of course it is. Of course it's the goal of making money.” Let's dig one level deeper, shall we? Why do people put their money away? Safety, security, freedom, self-esteem, just simply feeling OK about themselves—which I think is tremendously underrated as a motivator—power. These are the reasons we put our money away. It's not the money. It's what the money buys us. Money is a currency. In and of itself, it is useless. It is only the return, what we can exchange it for. And the ultimate payoff is emotional. But it points to something very important when we have conversations with our clients. As long as we're talking about the market and money and returns, we're going to be using the language of numbers. And the language of numbers is very handy, it's very useful, and we all use it and need to use it. But as long as you're talking about the numbers and not the translation to the real-life emotion and impact it's going to have, you're always going to be a little bit off-centered. You're going to be a little bit of a disconnect from where you're having that conversation and how to get to the gut of the client, where they can make a different decision and move forward. Perhaps said a little differently, all financial decisions are attempts to reach emotional goals. I like little formulas. It's worth a postcard. It's worth a little thing on the wall, if that's the sort of thing you like. E is greater than F. It’s always going to be more powerful. We talk so much about financial return on investment. We're going to be covering a concept I call the emotional return on investment.Looking forward, more fundamental principles. This is the bedrock stuff. This is what everything rests upon. Investors have different needs. People think their needs are financial, and that's why they invest their money. And to a point, they’re right. They think, “Well, I'm investing my money because I have financial needs. I need to be able to pay for my child's college. I need to save enough that I can retire. I need to have money so I can take care of my mom and dad.” We have these financial needs, but we also have emotional needs. We want to feel a certain way about ourselves and about our investments and about our lives in general. And as long as these two things are being met, as long as they are in alignment, life is good. There are no problems. That's the sign of a happy client. They're on track, their financial needs are being met, and they feel good about it. Wonderful. But sometimes, these two things get out of whack. A classic example of misalignment is perhaps something like what happened 13 years ago—the banking crisis. We have a financial need that may say, “Look, we need to stay the course. We need to be brave and take on what people would consider some risk.” But unfortunately, there's an emotional need that is in conflict. The emotional need is safety—“I just got to get safe. I can't take it anymore.” The problem with this is, of course, when push comes to shove, emotional needs always win, because they precede and supersede financial needs in the investing process. And I think a big part of what we do you, if you want another big-picture way to look at it, is to help disentangle, to help align, to help meet the financial needs while simultaneously meeting the emotional needs. And I think we can agree which one’s the most important. There’s plenty of examples of things like this. I mean, there are times when perhaps it's time to take profits, there's been a big run. But we have this emotional need for fun, and we're thinking, “Man, it's like house money in Vegas. I'm really going to let it ride now. I can afford to lose a bunch of this money because the position I'm in might pitch that so high.” And you end up giving away a lot of money because you're indulging this emotional need that's in conflict with a rational financial need. It’s going to be a big part of what we talk about. Click on the slide, and then you'll be back on. You must have clicked on something other than—Something popped up on my right side and made it hard to—Gotcha.Ah, there we go. There we go. Thank you, Andy. Nice save there, Mariano Rivera. So, exercise. I want you to take just a moment and jot down on a piece of paper, maybe typing away at a keyboard, think about, for a moment, a client who you consider the most challenging for you to deal with. It may come to mind very quickly. Go ahead, take a moment. Think of that person. Jot it down. Then I’d like you to answer another quick question: Why? Why are they challenging? What is it about this individual that makes them a challenge for you to deal with? And then, lastly, how do you feel when you are dealing with them? What’s your emotional reaction to them? I’ll give you just a little bit of time to think about that. And the reason I'm asking you to do this is because it makes a very good touchstone. I'm going to be talking about the curriculum going forward, and I want you to think in terms of how it can affect your client base, and how you can actually start to apply it in real life by thinking through how it would affect this individual. Let's face it, the clients who are easy to deal with, well, they're great, but they're not the ones who take up most of our time. It’s the ones who are challenging. And it is my fervent hope that through this course we can actually begin to reduce the amount of time spent on those challenging clients. So, I'm going to assume you got some stuff down. Please keep it in mind. I'll ask you to refer to it as we go along. Perhaps said a little differently, all financial decisions are attempts to reach emotional goals. I like little formulas. It's worth a postcard. It's worth a little thing on the wall, if that's the sort of thing you like. E is greater than F. It’s always going to be more powerful. We talk so much about financial return on investment. We're going to be covering a concept I call the emotional return on investment.

Now let’s take a look at the road ahead, a preview of some of the future classes for the financial counseling certificate. The first unit is going to be on trust. How many of you have ever been asked this question: “Don't you trust me?” Sometimes, it’s preceded with words such as “What's the matter?” or “Come on, don't you trust me?” Now, this question never feels right, does it? I mean, for starters, it’s kind of pushy. You know somebody’s trying to pressure you a bit, and that doesn’t feel good. But I think there's a deeper, more important reason why this question never quite feels right. It's because trust is not a black or white issue. It's not a yes or no issue. Trust is complex. It's situationally dependent. Do I trust you? I mean, I can think offhand of people who I would trust to do my taxes, others who I would trust to watch my kids, people I would trust with a large sum of money, people I would trust to complete a simple task. It depends.

We all talk about trust with our clients, and whenever I've asked an audience, “What is the foundation upon which your relationship, your entire business, rests?” the answer is always trust. And I agree. That's what it is. But I don't think that we always dig one or two levels deeper and see exactly what trust is comprised of. Trust is not a column. Trust is a three-legged stool. There are three specific types of trust. Each one must be there in a sufficient capacity, or relationships fall apart. And the first one is professional trust. In other words, trust in you as a professional. Are you competent? Are you excellent? Have they got the right advisor? This person is so good, they’d recommend them. Actually, believe it or not, that is the number one type of trust that we know clients and prospects want from an advisor. They want to know you're great at your job and they can trust that. The second type of trust is ethical trust. Are you somebody who has integrity? Are you somebody who will always act in their best interest? Are you somebody who they never have to wonder if they’re going to disappear with a large sum of money to an island in the Caribbean? And I'm not trying to be funny about that. I've worked with all sorts of people, and I can tell you that is something that drifts through most people’s heads. It requires tremendous trust to place yourself in the hands of a financial advisor. Not to be underrated.And then, lastly, interpersonal trust. Interpersonal trust is basically that trust you get when you're like, “Hey, I like this person. I can open up to this person. They care about me, and they understand me, and they respect me.” And we're going to talk about ways to build that interpersonal trust in some very specific strategies going forward. So, that's a preview of trust and what we're going to cover. I think you’ll like it. All right, let's talk a little bit about investor emotions. People talk about fear and greed a lot. I got to tell you, fear and greed are not like peanut butter and jelly. They're not like these two things that go together. The fact of the matter is, fear crushes greed every time. In fact, what Kahneman and Tversky determined, which essentially earned them a Nobel Prize, they determined something they call prospect theory, that the fear of losses, the pain of losses, is actually two times as powerful—they quantified it—as the equivalent joys in gains, what we call greed. Folks, if you simply learn how to help fearful, anxious, worried … Choose your adjective. They're all part of the same family. If you can simply help those clients navigate that emotion, it will do so much for your business, and put you in a different class of advisor. This is resistance. This is what it looks like. Have you ever been given this piece of advice? I bet you have. The advice is, “Hey, don't worry about things you can't control.” Was it helpful? I'm going to guess no, and I'm going to tell you why. Because, technically, this is a catch-22. Literally, the only thing we worry about are things we don't believe we can control. I mean, if we could control a situation, we could dictate our desired outcome, there’d be no need for control [laughs]. That’s the whole point. So, what does that mean? That means that it gives us a pretty good working—what we call in psychology an operational—definition of what fear is. Fear, if you want to boil it down into a nugget, is a feeling of a lack of control, and it gives us some levers we can use to help re-instill and build it back with our clients. Have you ever met somebody that you might describe as a control freak? A control freak is somebody who has anxiety and needs to control in order to fight that anxiety. I mean, honestly, the relationship between fear and control is like if you were hiking in Arizona and got bit by a rattler, and it injected fear into your ankle, they would rush you to a doctor and give you an injection of control. And that is what would make the problem go away. We'll dig in deeper. This is by far the most important emotion, but not the only one that matters.

Well, we have a couple more that matter. One of them is anger. We’ve all had angry clients. It is perhaps the most unpleasant and difficult client to deal with, the one that's really ticked off at you. We're going to talk about what anger is, how to defuse it. And it's one of my favorite subjects, actually, in this thing. And it does wonders, because it’s going to remove headaches and make you feel a lot better about some of the worst interactions that you've had as a professional. And we've all had them. Believe me, I’ve sat across from people and experienced it too. Another one, which may or may not appear, is grief, loss. I'm talking about loss in life, but also the loss of money. When people suffer a loss of their net worth, they go through a grieving process. We're going to talk about what that looks like. And then there are other emotions, too—hope, regret, exuberance. We're going to take Unit 4 to look at those and come up not just with an understanding, but some really good prescriptions on how you can move people past those things. A point that I would make is this: When it comes to investing, when people suffer a cut, like a loss of net worth—and I'm getting at grief right now—it actually behaves very much like a physical cut. The first thing you want to do is stop the bleeding, but the next thing you want to do is make sure it doesn’t get infected. And that's what happens to people. They suffer some kind of hurt from their investing, and instead of healing properly, it gets infected. It makes them angry. It makes them scared. It makes them other things that are nonproductive. And our job, really, is to basically disinfect, and move people past these losses they've had and these problems they’ve had. And once you do that, you have a healthy relationship. But a lot of times, that's really what the work looks like, just in a psychological form. Unit 5, we’re going to talk about counseling strategies and techniques. I really believe this statement is true. I invented it. I say, “Advisors don't say the wrong things to their clients.” You really don’t. What does happen is, advisors say the right things when the client is not yet ready to hear them. So, in this, we're going to talk about how to move people. It's going to be largely about increasing your influence with clients, but it's also going to be about how to take away pain and help move them forward. It's not just what people need to hear. It's having them emotionally receptive to it. Like trying to walk through the door when the window of opportunity, the door, is open. And there's really an art to it. I think that if you're like me … And believe me, this is the way I was when I was a counselor. I heard it from my supervisors all the time. I have a tendency to leap to solutions. I can see what the problem is. I go, “Oh, this is what the problem is.” And so, I tend to go there quickly because I want to help people in that way. It is a natural instinct, but it is not a productive instinct. And so, we're going to work on strategies that help communicate better, everything from listening to humanistic psychology. It's good stuff.

I mean, I hope you know that I enjoy this material, and I hope that you will enjoy this material too. This doesn't have to be dry stuff. This can be really interesting and fun. And investor identity is, to me, a really fun and super-important topic. I chose this picture, and many of you might be able to figure out why. It's from the old conversation many of us had with our folks growing up. I came home one day, and I did something foolish, like a 16-year-old might, and my mom said, “Well, what did you do that for?” And I would respond, “Well, everybody was doing it.” And what did my mom say in return? Everybody at once—“And if your friends jumped off a bridge, would you do that too?” And the fact of the matter is, the only honest answer to that question is, “Yeah, probably.” Because that’s the nature of peer pressure. And this is the single most underappreciated force when it comes to investing and client psychology. The market itself is a form of peer pressure, and I do mean that literally. Think for a moment. What moves the market? You're an investor, right? So, you're invested. You have your money invested. The other people investing are your peers. When your peers like something, it increases the demand. The price rises. That's what moves a market—peer pressure in favor of something. And what happens when prices go down? Sectors, stocks, bonds, you name it. The exact opposite. Your peers stop liking it, and it drives it down. This is why investing has a lot more in common with junior high school or high school than most people realize. Because the way we overcome the peer pressure … I mean, it blows people left and right. The market’s going up and down. We see the pressure it puts on people. The way we overcome peer pressure in investing is the same way we overcame it when were 15. We figure out who the heck we are. That is the psychosocial developmental task required of a teenager—“Who am I?” We need to help our clients do that, because that is the only way they can get themselves into a secure enough place where they don't feel the need to follow the winds that are blowing, or the fad. And unfortunately, and I say this with respect, your clients are adults, but in terms of their investor identity, most of them are teenagers. They know enough to be dangerous, most of them. They haven't quite figured out who they are. They don't have quite the experience. And because of that, they are at risk of peer pressure destroying what you have helped them build.

So, what does an investor identity look like? Well, it involves components. Goals—why are we doing this? Needs. We're going to do a section on the investing hierarchy of needs, a revisitation of Maslow. Some of you may be familiar with him. We’re going to talk about values, what's important. Beliefs. Strengths and weaknesses. And some weaknesses are very important. They're underrated. You have to know what you're good at and what you’re bad at. In fact, you may have noticed in that book … My book was called MarketPsych: How to Manage Fear and Build Your Investor Identity. This is a bit of higher level stuff, but I'm telling you, you can integrate these concepts into your interactions with clients in a very seamless way, and you will build stronger, better clients, who make your life easier, as well as their own. OK, investor personality. We're going to be talking about the five factors of investor personality. You might have heard somebody in your life describe somebody as having no personality. I can tell you right now, that is inaccurate. Everybody has a personality. People who are described as having no personality are just boring. And the reason we know that we actually have a personality is because they've done great research into this, and it boils down to five separate factors. I won't go into them too much right now, but these are reliable, valid constructions of human personality. And I have done a lot of research on this subject, as Andrew alluded to, with many people taking a test, and also research besides that, to see what the investing implications are for these different personality factors, these different traits. You may be familiar with them. But obviously, a client who is an introvert, who is high on openness but is very emotionally sensitive, you're going to treat that very different than somebody who's an extrovert, who's very traditional in their beliefs, very fixed. It's a wonderful tool to help profile and give you some skills to help navigate your relationships with clients. And in fact, it's going to be two units on that.

The Revised NEO Personality Inventory. OCEAN or CANOE model, it's called. Anybody who's familiar with a psychologist named Jordan Peterson, he made his bones studying these “Big Five” factors and applying them to human behavior. So, neat stuff.

Unit 9, this is pretty cool, I think. What we're going to do is take a bit of a departure from the usual curricula, and we're going to take a look at what's happening … I think it's going to be September 15th. Don’t quote me on that, but it's going to be sometime in September. And we're going to apply what we've learned so far with a case study, or perhaps a client that you suggest, because we do want to hear from you on this. Andrew wasn't kidding about that. You're going to help make this course better, and help me determine where your greatest needs and desires lie in this course. We're going to apply to current conditions, taking a look at what's going on geopolitically. What are the sort of emotions they’re experiencing? How does personality play into this? What techniques might we use? This is real life.

Mental health issues. Now, one of the things that I haven't said explicitly, but I think you've gathered, is that I'm not trying to turn anybody into a psychologist here. Honestly, that's not the goal. What we really want to do is help you work with people who are emotionally challenging. But sometimes, you're going to have clients whose issues go beyond the typical, and they're going to be legitimate mental health issues. And this section is designed to help you identify when that is, and help them get the help they do need. We're going to talk about things like the stressors in people's lives—divorce, death, job loss—the impact that those things have. We're going to talk about anxiety and depression, what are known as Axis I diagnoses. And we're also going to talk about what are called Axis II diagnoses, which are also referred to as personality disorders. When I say that, I am talking about things like narcissistic personality disorder, borderline personality disorder, dependent personality disorder. These clients are the most challenging. And we're going to look at things like yellow flags, and perhaps even red flags, because, let's face it, the ability to avoid working with a borderline client is in your best interest. These are the ones who make your life miserable, suck all of your time and effort out of a day, and then end up suing you. And if we have the means to identify that and avoid it, that is a good thing. So, we're going to talk about how to help people who have these deeper issues, the impact that mental health has on people's lives, and we're also going to talk about how to protect your business. Working with couples and families. I love working with couples. I think couples work is great. In fact, I really think of couples as being the client. I'm sure many of you do, too. We know that women tend to outlive men. We also know that upon the death of a husband, 70% of widows change their financial advisor within one year. The ability to work effectively with couples, get them in alignment, get good communication, and solidify the relationships with them is really a crucial X factor for your business. And we're also going to talk about families, family dynamics, intergenerational wealth. I’m going to cover that, as well.Unit 12. Hey, this is a review. Review and implementation. We’re going to revisit the foundations, emotions, counseling techniques, the concepts of the investor identity and personality. Then we’re going to look at mental health, as well. And we're going to wrap up on that happy note. Now, when you complete this course, this is not all of the skills, this is not an exhaustive list, but here are some of the things you will know. You will know about counseling psychology. You will have an understanding of investor emotions—how they happen, when they happen, and why. You will have insights into investor identity theory, which we know is the key to resisting peer pressure. It's basically the maturation of the investor. And personality psychology—insights into a style people have, which obviously has big implications not just for your relationship, but also for the type of investments that they hold. Also, skills. Techniques for building trust. We're going to talk about those. Active listening, counseling techniques, humanistic psychology, personality profiling with clients and prospects, and the ability to identify potentially risky clients. Wrapping up, we’ve got benefits of financial counseling. Increased AUM. One of the things I truly believe, folks, is that if you can implement these principles and skills, you will be an indispensable partner to your clients. And you know what? Let me just say, I know that many of you are that right now. I hope you see yourself that way with your clients. But this will help build that, and help make that more of a reality. And this is really important for AUM. I’m going to tell you why. Because the average client has 2.5 advisors. That is 2.5 people, on average, who have some control or influence over their money. But when you work with somebody on this level, you are accomplishing 100% of what that client needs, 100% understanding and vision and goals. And what happens in the mind of a client is, “How can I realize that vision that I have worked on with you when they only have 50% of my money? They need to have 100% of my money.” It is a natural downhill slope to wallet share for you, because it makes people say, “I don't want to work with anybody else. It's just getting in the way of doing what I need to do.” Client retention. Better relationships go a long way. And also, in the mind of clients, if you can really work with them on this level, think of the amount of work it would take for them to duplicate that with somebody else. They don’t want to do that kind of work again. They know somebody else isn't going to understand them and relate to them the way you do. That makes a client who sticks with you for the long run and also refers people. Prospecting. We've talked about ways to distinguish your business from all the others out there talking the talk. That’s going to be an advantage. Better relationships, more satisfying. More confidence. Let me just say this. It's hard interacting with people. Conversation is like a tennis match. Somebody hits the ball to you, you got to hit it back. Sometimes I'll ask people, in a session, in a seminar, “So, your client says X. How do you respond?” And people will typically, in the audience, respond, “Well, I guess I'd want to tell him this.” And I go, “No, I mean what would you actually say?” And they go, “Well, I would tell them, maybe…” No, no. Here's the problem. Conversations are hard. They go at rapid speed. We need to be fluid. We need to be in touch and have that communication, that rapport. So, when somebody says something, we have to actually respond back with a sentence. And believe me, I am not making light of this. This is the most challenging thing—the art of conversation, the art of response. You're going to be more confident. You're going to have the words more handy. You're going to understand and see where to go to more easily. And you're going to be able to communicate more effectively. So, those challenging, tough discussions, they’re going to get easier, and it's going to feel good.Lastly, efficiency. Look, if we can implement these principles, it should mean less hand-holding, less earfuls, fewer headaches, and the ability for you to concentrate your time where you want to concentrate your time, and to build your business. So, this is an overview of financial counseling. I realize that I have covered a wide breadth of material, not deep depth of material. But that's why we got 11 more classes to go, folks. We're going to get into this stuff. We're going to dig in. And I'm going to use your feedback to make it even better. And I truly believe that if you can implement these skills and principles, you are in wonderful shape for the future of this profession. Thank you.

A4A Launches 12-Credit, 12-Week Financial Counseling CE Course

- Details

- Written by Andrew Gluck

- Category: A4A News

On March 30, 2021, the CFP Board announced a revision to the principal knowledge topics a CFP® professional is required to master. A completely new topic was added: the psychology of financial planning.

Until now, you did not need to know anything about psychology to be a CFP® professional. Effective Jan. 1, 2022. however, the psychology of financial planning will comprise seven percent of what you must know to hold a CFP® designation.

Until now, you did not need to know anything about psychology to be a CFP® professional. Effective Jan. 1, 2022. however, the psychology of financial planning will comprise seven percent of what you must know to hold a CFP® designation.

The CFP Board action has repercussions beyond the CFP® designation. CFA Institute for years has included behavioral finance education in its exam. CPA financial planners, CPA/PFS®, and CIMA® practitioners are almost certain to add financial psychology to their knowledge requirements.

Changes to knowledge topics by CFP Board occur rarely and at glacial speed. The CFP Board’s Practice Analysis Study, which drives changes in knowledge, was last updated in 2015.

The action formally recognizes knowledge learned from the burgeoning social science of behavioral economics, a field first recognized for its contribution in helping to improve society through knowledge in 2002, with the award of a Nobel Prize in Economics to Daniel Kahneman, and again in 2017 with the Nobel Economics Prize awarded to Richard Thaler.

|

Certified Financial Counselor™ CE Course The 12-credit Financial Counseling certificate curriculum is free with A4A membership. View the Certified Financial Counselor™ curriculum and schedule.

Investor Behavioral Coach™ CE Course Also free with A4A membership is the Investor Behavioral Coach™ Certificate, which is earned by completing a one-hour class annually in addition to three- one-credit introductory classes in the first year. View Investor Behavioral Coach™ Certificate course curriculum and schedule. |

The CFP Board’s recognition of the importance of psychology in financial planning coincides with changes to A4A’s curriculum in the works for many months. Spurred by growth in the number of high-income and high-net worth individuals as well as advances in behavioral economics, the nature of advisor-client relationships has grown more personal, collaborative, and deeper, requiring skills in counseling as well as technical knowledge.

A4A’s mission is to teach current facts about investment, tax, and financial planning, with no commercial influence in a 24/7 CE stream for Certified Financial Planners™ That’s why A4A added psychology of financial advice topics to its core curriculum in July 2021.

The new continuing education courses enable financial advice professionals to earn two certificates: Certified Financial Counselor™ and Investor Behavioral Coach.™

The two new certificates are complementary to the comprehensive designations earned by CFP®, CFA®, CIMA®, CPA and CPA/PFS® professionals. The CFC™ and IBC™ are “micro-credentials,” meant to be earned alongside one of the comprehensive designations for financial advice professionals.

Designation proliferation has caused massive confusion for consumers for decades now. Micro-credentials are a technology solution to the confusion over designation proliferation. All of the major accreditation bodies are issuing digital certifications and the CFC™ and IBC™ jibe with their values digitally as well as knowledge-wise.

AICPA, CFA Institute and CFP Board are already issuing digital certificates to authenticate professionals. These accreditation bodies of the comprehensive designations have adopted certificates that are digitally authenticated for their respective professionals to try to clear up some of the consumer confusion over the proliferation of designations.

Micro-credentials are certificates that are digitally managed and can be displayed as “badges” on your website, social profiles, and email signature to highlight a specialty. Other micro-credentials cover retirement income planning, alternative investments, and divorce planning. A4A is where you can come for CE in the psychology of financial planning and learn how to better fulfill your role in financial counseling.

A4A instructors -- Fritz Meyer, Bob Keebler, and Craig Israelsen -- are leading educators of tax, financial, and investment planning professionals and Frank Murtha fits right in with our outstanding lineup. Dr. Frank Murtha earned a doctorate in Counseling Psychology from the University at Buffalo in 2000. In 2001, he co-founded the consulting firm, MarketPsych LLC, which specialized in helping financial professionals apply financial psychology to build better relationships, gain referrals, increase assets under management and improve investment returns. Dr. Murtha has taught at City University of New York and New York University, and is the co-author of the critically acclaimed MarketPsych: How to Manage Fear and Build Your Investor Identity, named one of the “Best 3 Financial Books of the Year,” by Kiplinger’s Personal Finance. In 2021, he founded the Financial Counseling Institute to provide advanced training and certification to financial advisors and planners.

Acknowledgements

We are grateful to Professor Stephen Horan of University of North Carolina. Prof. Horan, who was responsible for CFA Institute's education initiatives for 14 years until December 2020, has been an invaluable resource in selecting financial psychology thought leaders. Steve has been in the "catbird" seat of the profession for many years, researching the best educators and designing online courses for professionals and he generously shared his contacts and knowledge of micro-credentials.

We are also grateful to Andrew Fama, J.D., MRFC®, AEP, MHA, and a former Visiting Professor, John Wiley Jones School of Business, State University of New York at Geneseo, NY. As smart as he is, Andrew Fama's kindness, humanity, and good intentions are his best qualities.

Estate & Asset Protection Amid Covid Pandemic

- Details

- Written by Andrew Gluck

- Category: A4A News

Benefiiciaries and grantors in families with taxable estates are likely to face higher taxes, because of the weakening U.S. balance sheet.

Below is the transcript of a continuing professional education class eligible for free continuing education credit to A4A members.

The matters discussed require urgent attention of private wealth advisors, family office professionals, and UHNWIs.

Gideon Rothschild: Hello, and thank you for attending today’s webinar. I am Gideon Rothschild, Co-Chair of Moses & Singer's Private Client Group. With me are my partners, Carole Bass, Daniel Rubin, Irving Sitnick, and Ira Zlotnick. And today we’re going to talk about Navigating a Perfect Storm: Estate and Asset Protection Planning in a Pandemic. As you all know, we’re all sheltered, or we’ve been sheltered for some weeks now. Many clients have been asking about what they should do about updating their documents and whether their documents should be updated, as well as what benefits exist today due to some confluence of factors that we’ve been experiencing, between the low interest rates that we’ll be discussing, depressed values, and the relatively high exemptions for gift and estate taxes. And how can we take advantage of that? So, to start us off this afternoon, I’m going to introduce Carole Bass, who will take us to our first slide.

Rothschild: By the way, if you have questions you’d like to ask, there’s a Q&A button that you can submit your questions through. And at the end we will have, hopefully, some time to take those questions. Thank you. Carole, go ahead.

Carole Bass: Thank you, Gideon. First of all, welcome to everyone, and I hope that everyone on the call and their families are safe and well at this time. The current pandemic has encouraged many people to create or review their estate planning, as we have all been forced to face our own mortality. Also, as a result of the pandemic, our world is changing. And many of these changes will have long-term impact on all aspects of our lives, including on estate and asset protection planning.

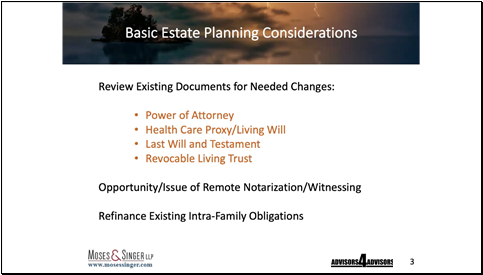

Changes in the economy will affect our spending and our lifestyle needs, as well as how wealth is created and depleted. Clients and their beneficiaries may also change residency, as many people are expected to flee from larger, urban areas and from more populous sections of the country out to suburban and rural areas. It’s also anticipated that there’ll be changes in state and federal income and transfer tax as a result of the budget shortfalls from the pandemic. Our current federal estate and gift tax exemption of 11.58 million is already set to sunset on January 1st, 2026, and it will revert to half of the current exemption, but change may come sooner if there’s a change in administration in 2020. So, while it’s an opportune time to do some advance planning and to think about asset protection, all of which we are going to cover later on in the webinar, it’s also an important time to establish or update your core estate planning documents.

Bass: So, what constitutes this core set of documents? First, a durable power of attorney permits someone else to manage financial matters while you’re living. The power of attorney lets someone else pay bills, write checks, or sell and purchase assets on your behalf. This may be more important now, during the pandemic, for the elderly and infirm who are unable to leave the house, or for those who have become hospitalized.

A health care proxy names someone to make medical decisions if you’re unable to express your wishes. This is really top-of-mind for a lot of people now, understandably. Also, a living will allows you to leave written instructions that explain your health care wishes, especially about end-of-life care. While New York doesn’t have a law governing living wills, our highest court, the Court of Appeals, has stated that living wills are valid as clear and convincing evidence of your wishes. So, it’s important to document these. With those documents, a consideration during the pandemic might be whether there should be someone in the line of agents that you’re appointing who lives in another household, so they wouldn’t be exposed to the virus if you’re exposed. And it’s always important to think through possible future health care scenarios and to have conversations with your family and your friends, or whoever you’re appointing, about your wishes, so that they’re made aware.

A last will and testament and/or revocable trust contains the dispositive provisions that take effect at your death. These should be reviewed to make sure they conform to your current wishes, that your executor and trustee appointments are current, as are the appointment of guardians for minor children. Also, not on the slide but very important, is to be updating beneficiary designations on retirement plans and life insurance policies. Those pass outside of the will or revocable trust, and often people neglect to update those.

With more people than ever trying to complete and execute their estate planning documents, we’ve been forced to find kind of new and innovative ways to get these documents completed while maintaining social distancing. Most frequently, we’ve been arranging for remote video signings for these core documents that I just spoke about. In New York, we have executive orders from Governor Cuomo permitting remote notarization and also permitting certain documents, including those that I just mentioned, to be witnessed remotely. That executive order has now been extended to June 6, and we’ve all become comfortable with that process. It does require some comfort with technology, as clients need to use Zoom, GoToMeeting, or another app that will provide two-way video communication, and then they need to be able to scan the signature pages to the notary and the witnesses on the same day and use Federal Express to get the originals out. If scanning is too complicated, especially for more elderly clients, we’ve been having people snap pictures and text or email those photos. So, there’s always a workaround.

There’s also an ability to do live signings and maintain social distance, especially out in the suburbs, if people can stand far away from each other or do this through windows, either home windows, car windows. There is some concern, however, that once the restrictions on social distancing and the quarantine officially lift, people will still be hesitant to sit in a conference room with three or four other people for what is an old-fashioned signing. We really don’t know if any of these orders on remote witnessing and notarization will stay in effect beyond the shelter-in-place order, so we need to monitor that.

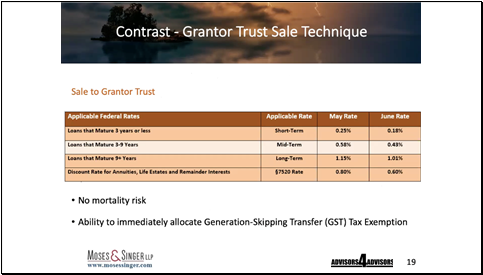

I also want to really quickly mention on this slide, it’s a good time to refinance existing intra-family obligations. The AFR rates are at a historic low, as will be discussed in more detail later. The rates for May are 0.25, 0.58, and 1.15, and they’ll be even lower in June. Next slide.

Bass: More and more often, we’re recommending that clients set up revocable trusts during their lives to avoid probate. And historically, we haven’t done revocable trusts as a matter of course in New York, but that is changing, and started to change before the pandemic, just due to the volume and delays at the court. And on this slide, you’ll see some particular reasons why revocable trusts were used in the past, but it’s become even more important for people to think about avoiding probate. And the pandemic has made this even more clear, as courts for a while were closed and are now only handling limited matters.

So, a revocable trust provides for ease of administration, both at death and in the event of incapacity during life. It avoids the normal time delays you would have in court, and the extent of the delays we have now. But for this to work, the trust has to be funded during life, so you need to retitle assets, including bank and brokerage accounts, real property. Otherwise, you’ll end up probating anyway, to move those assets. As I mentioned, the value of probate avoidance became very clear at the onset of the quarantine. Courts were closed and there was really no means to even get a fiduciary appointed following a death. And the market was falling, and there really needs to be someone in place to secure assets, to be able to sell security, and to marshal funds, especially if there’s a surviving spouse who might need those. So, with that said, I’m going to turn things over to Dan, who’s going to discuss asset protection.

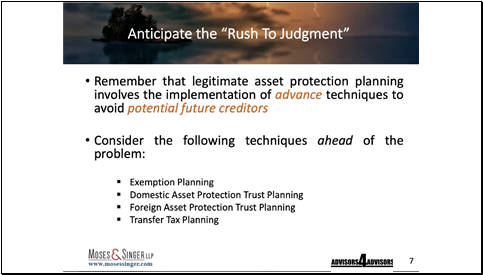

Daniel S. Rubin: Thank you. So, the confluence of factors that exist that make this a good opportunity for estate planning, some of those factors also suggest that this would be an excellent time for clients to consider or reconsider their asset protection planning. Specifically, the economic situation that we find ourselves in, with tenants often not paying their rent, for example, and the personal guarantees that people have signed in favor of the banks and other creditors, which may generate personal liability at some future point in time because of a continuing economic situation, recession or depression, suggests that people should consider whether or not they ought to do what they can at this moment in time, before the problems really come, to protect themselves.

And this definition on this screen, that asset protection planning is the process of implementing advance planning techniques to protect against potential future creditors, has the word “advance” and the phrase “potential future creditors” highlighted and italicized because it’s important. In fact, it’s critical that this planning be done, as all planning must, in advance of a problem, and that it be undertaken only to avoid what are called potential future creditors, not existing or anticipated future creditors. And this suggests that there’s no better time to undertake asset protection planning than this very moment. Let’s take a look at the next slide.

Rubin: The reason why asset protection planning must be done in advance of a problem and to protect only against anticipated future creditors is because of the law of fraudulent transfers, which has sometimes been referred to as fraudulent conveyances or, today, voidable transactions. Essentially, all of those suggest that the law doesn’t permit transfers to be made if they’re done with the intent to hinder, to delay, or to defraud one’s creditors.

And in this regard, the law distinguishes between several different types of creditors. Present creditors and anticipated future creditors, what this slide refers to as subsequent creditors, those two types of creditors are creditors against whom a transfer will either definitely or very likely be found to have been made with the intent to hinder, delay, or defraud. It’s only those potential future creditors, meaning those nameless, faceless persons of whom no awareness exists at the time that the transfer is made, that the law will respect those transfers as not having been made with the intent to hinder, delay, or defraud. So, it’s always important, and especially at this point in time, to engage in this planning as far in advance of a potential creditor problem, so that the creditors that may later complain will be found to be potential future creditors, not existing or anticipated future creditors. Next slide, please.

Rubin: In anticipation of this potential rush to judgment that may come in the next several months or over the course of the next couple of years, what might clients think about doing? Well, this slide suggests that there are probably four things. And we don’t have the time to get into them in any great detail, but let me highlight what these four items, these four bullet points at the bottom of the slide, suggest.

The first is fairly simple exemption planning. That is, converting assets that are completely available to creditors to assets that the law provides are unavailable to creditors because the law, either federal bankruptcy law or state debtor-creditor law, provides should be exempt from creditors. And there are any number of useful sorts of assets into which available assets might be converted. So, for example, a homestead exemption or life insurance or annuities are suggestions of assets that are exempt from creditors, as well as retirement plans. We have techniques whereby assets can be converted into these protected forms of assets without it being deemed to be a fraudulent transfer.

Next would be domestic asset protection trusts, which are currently available in 18 states, by which I mean that there are 18 states that permit domestic asset protection trusts to be established under those states’ law. But I like to say that there are 50 states that permit domestic asset protection trust planning, because the fact that your client is a resident of a state like New York or New Jersey, which don’t provide for domestic asset protection trusts under their own laws, doesn’t mean that if the work is done in advance of a creditor problem, that they can’t establish an effective trust under the law of one of the 18 states that does permit it.

Similarly, residents of any state can create a foreign or offshore asset protection trust to take advantage of the laws of about 20 foreign jurisdictions that permit asset protection trusts. Foreign asset protection trusts might be, or might not be, a better fit for any particular client situation. Certainly, we would think about a foreign asset protection trust for clients who want to place assets, or already have assets, overseas, because they might enjoy a more robust protection from potential future creditors when they have a foreign asset protection trust that’s combined with an asset that’s located overseas.

And finally, we have transfer tax planning, which much of the balance of this webinar is going to address. But the idea is that with the significant exemption of 11.58 million dollars from gift tax, low asset values, and low interest rates, clients should be taking advantage of the opportunity to transfer assets into trusts for estate tax planning purposes. The benefit of transferring assets for estate tax planning purposes is that it avoids, or assists in avoiding, the argument by a disgruntled potential future creditor that the transfer was made with the intent to hinder, to delay, or to defraud them. Instead, of course, it wasn’t done for those purposes. It was done for the purpose of saving the next generation millions of dollars, or tens of millions of dollars, or sometimes hundreds of millions of dollars of estate tax. Next slide and speaker, please, which I think is Irv.

Sitnick: I’m pleased to be speaking. I’ll start again. My limited purpose is to introduce the estate and gift tax planning section of the program. Simply, the goal of estate planning, from a tax perspective, is to transfer assets with as little friction as possible. The friction being taxes—estate, gift, generation-skipping, and income tax planning. The federal government imposes an estate tax on all assets owned by a decedent at a maximum rate of 40 percent. As the slide indicates, our New York area jurisdictions– New York, Connecticut, and New Jersey—have some tax. New York, Connecticut, an estate tax. New Jersey, an inheritance tax.

One of the interesting things about the state tax is that the rules are slightly different than the federal situation. The most important element in the federal estate tax planning now is the existence of an exemption. It’s been mentioned several times before. It’ll be mentioned again. That $11,580,000 exemption is, in effect, funny money. It doesn’t need to go to charity. It doesn’t need to go to the spouse. It can go anywhere one wants, and there is no federal estate tax payable. And it could be transferred during lifetime, and there’s no gift tax applicable to it.

The issues that have been mentioned before, why is this a perfect storm? I think it’s been mentioned several times before, but my own spin on it is that not only are interest rates low, which we will see, and asset values are low, which we will see as well, but we have an election in November. And I think, from my perspective, from a planning perspective, that’s the key point. If there were to be a Democratic House, president, and Senate, it is almost certain that that $11,580,000 exemption would disappear. At the best, it would be reduced by more than half to five million. The rates, at 40 percent, are undoubtedly going to go up. It’s therefore critical for planning purposes that if action is to be taken, it be done this year. Unless one wants to bet on the election. Next slide, please.

Sitnick: This slide is intended to illustrate in a very simple way the advantage of acting now and taking full advantage of the $11.58 million exemption, which, by the way, for husband and wife, is doubled to 23 million dollars. In effect, this slide indicates that if 11,580,000 dollars were transferred in trust, it earned 5 percent a year over 10 years—that’s 5 percent after tax, which could be handled either by exceptional returns or by a grantor trust, which has been mentioned, and which will be mentioned again—at the end of 10 years there’s 18,862,000 dollars of assets remaining. That amount can be transferred to the beneficiaries free of any tax consequences whatsoever.

If, on the other hand, that 11,580,000 dollars had been retained by the transferor, and if he or she died in 10 years, the estate tax payable would’ve been approximately 50 percent at current rate, or 9,400,000 dollars. The transfer to children, assuming that’s where the assets are going, would’ve been reduced from 18 million to 9 million, a 50 percent reduction. This is simply just a very simple illustration of the power of the exemption and why it should be used now. Next slide, please.

Sitnick: The speakers who have preceded me have mentioned several times how low interest rates are. What this chart does is illustrate just how low they are. The Section 7520 rate, which technically is 120 percent of the AFR rate, is simply the rate that the Treasury uses to determine whether a transaction is, in effect, quote, “arm’s length,” end quote, for planning purposes. That rate, as you can see, has been 6 percent, 7 percent. If you go before 1997, it was much hotter. It is currently less than 1 percent. It’s 0.8 percent.