There is a Painful Pattern to Stock Market Hot

There are many advisors who tell clients that there is a pattern to the stock market. Many believe that in the long-run, it will go up in a stair-step pattern. I agree, but it can feel like a ramshackle staircase.

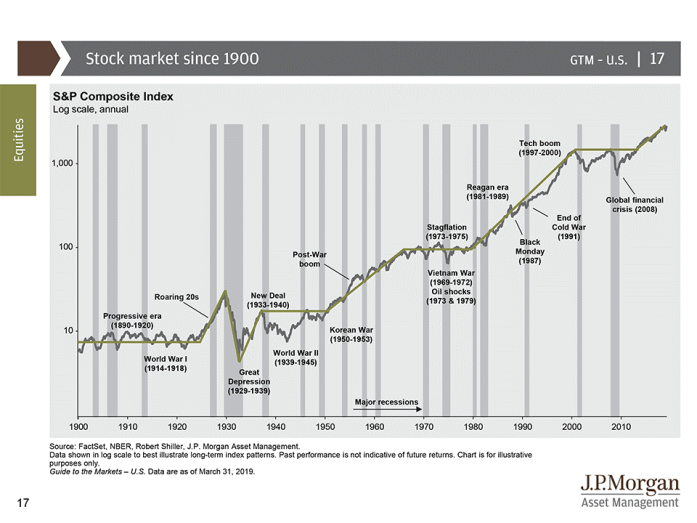

The Stair Case pattern (the graphic is from JPMorgan and shows the last century of annual equity returns)

The identified pattern is a stair-step pattern of growth and then flat and then growth again. What causes this pattern? The stock market is a reflection of the greater business and social environment. When businesses expand, the cost of that expansion is not immediately profitable. You can't hire half a supervisor to get incremental work done and make incremental profits. Each business must take a leap of faith and capital that takes a few years to recover via profit. So, in the aggregate, so does our market and our economy. Further, we always have new businesses entering the marketplace and some businesses failing or consolidating.

In macroeconomics, there are academic equations where (in the aggregate) we assume that the economy can balance the marginal costs and marginal revenue to maximize profit at any given level of market equilibrium. Such economic assumptions are a nice concept, but truly do not fully occur in the global environment and especially in a personal portfolio. No level of asset allocation removes the impact of this systematic risk.

What is that systematic risk that every investor experiences?

Within the growth phases of the market , within the consolidation phases, and within the recessionary phases; there can be a lot of painful volatility that interferes with your client's ability to enjoy their planned life.

It is critical to remember, that every dip in value and with every uncertainty of the capital being restored, a client's life changes- Emergency funds lost, savings lost, retirement changed, college funding lost. I compare it to a ramshackle staircase where all the steps do go up, but the steps are not even, stable, and footing is uncertain. You and your clients need to hold on to the rails and each other. You and your clients need to be prepared to climb the staircase together, using the tools and industry best practices. Just as you would be careful to climb such a staircase in a building, you and clients should be careful to climb it in the investing world.

The solution- a Financial Plan and a process to monitor the progress; planning together for the next step. As a CERTIFIED FINANCIAL PLANNER and a fiduciary, your clients expect you to be there for them. To give them the advice that serves their best interests. The advice and the relationship that provides confidence to achieve the goal because this is not the first time you have climbed the steps. They are not alone, they have You.