Technology

Fritz Meyer: Signal To Noise Ratio

- Details Category: Advisor Applications

The current signal-to-noise ratio in the economy is an anomaly. That's the current message Fritz Meyer suggests delivering right now.

Fritz's views on the economy are summarized in a Weekly Investment Update email you can send to your clients every Friday night. It's timely news for long-term investors delivered in an article with graphics.

On Tuesdays, a video based on Fritz's ideas is posted on your YouTube channel. The video feeds a widget in the sidebar of advisor websites. Visitors to your website can view the video by signing up for your email newsletter.

In addition

Advisor Productivity Tip (Video)

- Details Category: Software

If you take the time to learn how to use the Quick Access Toolbar in Microsoft Office, you will save time every day.

I took the time about three years ago to learn how to customize my quick access toolbar in Word and PowerPoint, and it ha saved me countless clicks.

When I want to align items, add a text box or shape, change fill colors, all of the buttons are on my toolbar. Instead of hunting for items in the ribbon, you can place the buttons you use the most in a toolbar. This quick video teaches you how.

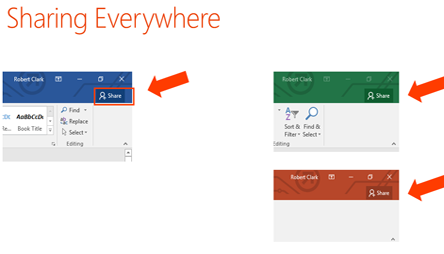

Do You Know How Easy It Is To Share & Collaborate Using Office 365?

- Details Category: Software

In the highly-regulated financial advice profession, independent advisors sharing ideas using Office 365 unlocks competitive advantages driven by their unique ideas — the intellectual property, processes, and practices only they can provide. However, Office 365 unlocks these benefits only if you take time to learn how to use it. At this session, we went over basic and advanced features in sharing documents in Office 365’s cloud-based system.

For an advisor leading a team, Office 365 is the best platform for sharing your ideas with your staff, and for your staff to share ideas wit

Don't Lose Your Life!

- Details Category: Phones

If you're like me, your cell phone contains your life. The contents of your phone include your contacts, appointments, to-do lists, instant messages, photos, business applications, mail, travel tools and more. Yet, it can all be lost at the drop of a hat, I mean, phone.

Rober Clark Answers Questions From Office 365 For Advisors Training Session

- Details Category: Software

For 18 months, Advisors4Advisors has produced Office 365 for Advisors Training webinars, featuring Robert Clark, a consultant who focuses his marketing automation consultancy on independent financial professionals.

The 2016 curriculum is posted and you can sign up here for the series.

Office 365 is one of the most popular apps to financial advisors. Robert Clark is helping advisors drill into practical issues for managing a professional services firm that provides investment management or financial planning advice. You won't find in-depth coverage like this anywhere. If