4Q2012 GDP Report Was A Clunker, But A Powerful Engine Is Under The Hood

The economy ended 2012 in good and improving shape. Hidden under the clunker headline of a -0.1% contraction in fourth quarter real GDP (from the previous quarter at a seasonally adjusted annual rate) was some serious horsepower:

- personal consumption expenditures – the bulk of the U.S. economy – motored ahead at a healthy +2.2% rate and the best in three quarters

- corporate cap-ex, which was supposed to have slumped on “fiscal cliff” concerns, jumped at an +8% rate, the strongest clip in five quarters

- residential housing expenditures positively burned rubber, up at a +15% annual rate

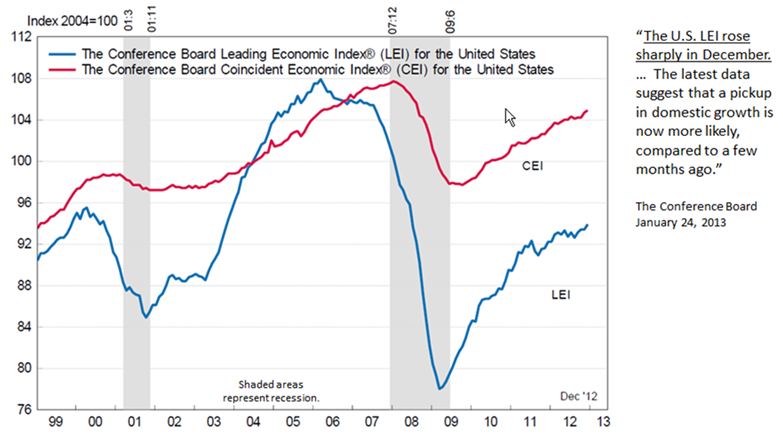

It may be time for the market to take a rest, having already achieved half the +10% consensus return forecasted by 12 Wall Street strategists in Barron’s in December 2012. However, it’s pretty clear from the data that the U.S.’s economic momentum is improving and stocks. Iin my opinion, we have every reason to continue in the direction of the experts’ target over the remaining 11 months of this year.

For a more thorough review and analysis of the latest economic and stock market data, please tune in to my monthly A4A webinar on Tuesday, February 12, at 4:00pm EST.