Right To Use CFP Mark Revoked For Leader Of International Association Of Registered Financial Consultants, Edwin Morrow; CFB Board Acts On Complaint Against The Man Behind The RFC Designation Hot

Write Review

Who Is Ed Morrow?

Who Is Ed Morrow?While CFP Board routinely announces revocations in its periodic disclosures of public disciplinary actions against CFP designees, Morrow’s case is notable because of his long tenure as a prominent figure in the financial advice business.

Morrow is the granddaddy of experts on financial advisor practice management. “He started using computers in his practice in 1970,” according to his bio, “and lectured across the U.S. on the use of computers in financial services during the seventies and eighties.” Before there was a Bill Winterberg, Michael Kitces, Joel Bruckenstein—before there was even an Andy Gluck—covering practice management for advisors, there was Ed Morrow.

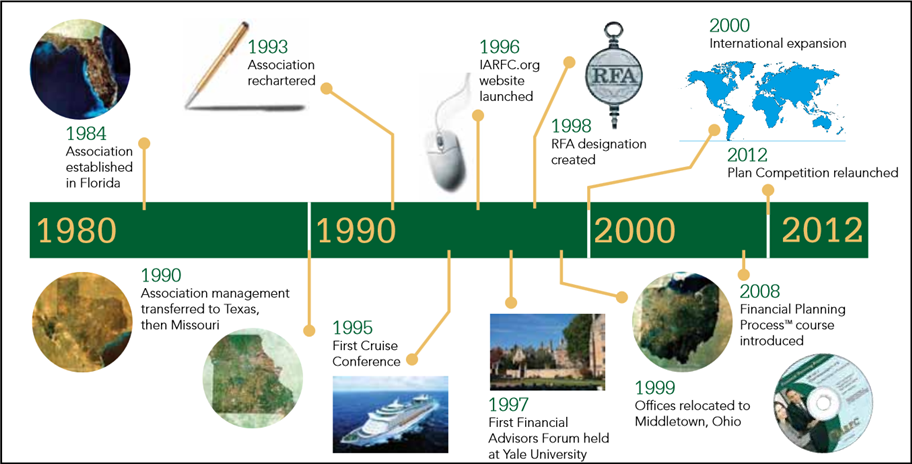

In addition to running the not-for-profit IARFC, Morrow has for decades produced client content and software for financial advisors at his company, Financial Planning Consultants (FPC) of Middletown, Ohio. Morrow is better known to financial advisors active in the Million Dollar Roundtable than to CFPs doing business as investment advisors.

IARFC

According to IARFC’s website, 8,000 financial advisors receive IARFC’s monthly magazine, The Register. IARFC’s mission statement reads: “We serve the professional advisors who help their clients wisely spend, save, invest, insure, and plan for the future to achieve financial independence and peace of mind.” Its code of ethics begins with the pledge: “I will at all times put my client’s interest above my own,” and the code is available for purchase as a wall plaque for $60.

What did Morrow do to deserve having his CFP designation yanked? The CFP Board, which announced the revocation six months ago, offered this public explanation of its disciplinary action:

CFP Board Revocation

“In November 2012, CFP Board issued an order permanently revoking Mr. Morrow’s right to use the CFP® certification marks. This discipline followed CFP Board’s investigation of allegations that Mr. Morrow: 1) used copyrighted work without permission from the copyright holder; and 2) sold copyrighted materials to clients without permission from the copyright holder. CFP Board’s Complaint alleged that Mr. Morrow’s conduct violated Rules 101(b), 102, 606(b) and 607 of CFP Board’s Code of Ethics and Professional Responsibility and Rules 2.1, 4.4, 6.1 and 6.5 of CFP Board’s Rules of Conduct, providing grounds for discipline pursuant to Articles 3(a), 3(f) and 3(g) of CFP Board’s Disciplinary Rules and Procedures (“Disciplinary Rules”). Mr. Morrow failed to file an Answer to CFP Board’s Complaint within 20 calendar days of the date of service, as required by Article 7.3 of CFP Board’s Disciplinary Rules. In accordance with Article 7.4 of the Disciplinary Rules, the allegations set forth in the Complaint were deemed admitted, and CFP Board issued an Administrative Order of Revocation.

Morrow’s Side Of The Story

Morrow, 73, and retired from practicing as a planner, says CFP Board “treated me unfairly.”

According to Morrow, the revocation of his right to use the CFP designation stemmed from a business dispute with a CPA firm over the unauthorized use of the CPA firm’s marketing materials. Without his knowledge, Morrow says an employee of his marketing technology company, FPC, used the CPA firm’s copyrighted materials. FPC sells financial planning and CRM software, and the CRM comes with 3,000 pages of template content that advisors can use in their letters and other client communications.

According to Morrow, the accounting firm wrote him a letter informing him FPC had copied the CPA firm’s client communication materials without authorization. In the months between the time the content was used by FPC and the time the CPA firm contacted him, Morrow says he sold FPC. “The accountant involved had a legitimate issue, but it was between his corporation and mine.”

Morrow says the CPA firm’s content was sent to and potentially used by 300 or 400 advisors and that he tried to negotiate a settlement with the CPA firm. Morrow says the CPA firm insisted he provide a list of all of FPC’s clients. “I was not going to give someone our customer list, especially since the company had been sold,” says Morrow. Unwilling to provide FPC’s customer list, Morrow says he and the CPA could not reach a settlement, and the CPA then filed a formal complaint with CFP Board.

“This was a disagreement between two corporations,” says Morrow. “I was not practicing as a planner. I thought the CFP Board was unresponsive to the fact that this was an issue between corporations and should have nothing to do with my CFP designation. “

Morrow says he sent a letter to CFP Board saying an FPC employee was responsible for using the CPA firm’s material and that the disagreement was between two companies and should not affect his CFP designation. “The CFP Board pursued it anyway,” says Morrow. “I frankly got pissed off after more communications and resigned.

How American College Handled The Matter

Morrow says CFP Board “totally ignored the fact that this same accountant sent the same complaint to the American College and they have a review process. I sent them (The American College) the same letter saying this was a business dispute and American College agreed.”

Like CFP Board, The American College of Financial Services is a not-for-profit financial services designation body. Founded 86 years ago, The American College administers the Chartered Financial Consultant (CHFC), and Certified Life Underwriter (CLU) designations and other designations popular in the insurance industry.

“CFP Board, whatever motivations they may have” Morrow says, “decided to pursue it and I ended up in a contentious situation with the staff.”

“The process they would use to review things would have cost me $25,000 or $30,000 to review,” according to Morrow. “And, frankly, the attitude of their staff (CFP Board) made me think it made no sense to pursue. The American College let it go and said it was a business dispute and not an issue of Ed Morrow practicing as a planner doing something incorrect.”

Retaliation Allegation

Morrow implied that CFP Board’s action was retaliation for his work in creating and administering the RFC designation.

“I can’t prove what motivated CFP board,” he says. “But I have my doubts.”

“I have been supporter of the financial planning movement since the very beginning, and charged my first planning fee in 1966,” says Morrow. “I’ve never done anything unethical. So you can understand why I would have questions in my mind about their actions.” Morrow was implying that the success of IARFC might have influenced CFP Board to act against him in the copyright matter.

Requirements For An RFC Designation

Morrow says the IARFC has 2,500 members in the U.S. and 6,000 outside the U.S., mostly in Asia. Morrow maintains the designation is credible. How difficult is it to receive the RFC designation?

“Applicants must have earned a baccalaureate or graduate degree in financial planning services with strong emphasis in subjects relating to economic, accounting, business, statistics, finance, and similar studies,” says IARFC’s brochure, “or have earned one of the following professional degrees or designation: AAMS, CFA, CFP®, ChFC, CLU, CPA, EA, JD, or completed a CFP® equivalent or IARFC approved curriculum at an accredited college or university. The Financial Planning Process™ course curriculum qualifies.

Requiring an undergraduate or graduate degree in financial planning is a pretty stiff requirement, as is earning an AAMS, CFA, CFP, ChFC, CLU, CPA, EA, JD. However, qualifying for an RFC by taking the Financial Planning Process curriculum is far less difficult.

The IARFC's Financial Planning Process curriculum is comprised of six classes. According to staff person who answered the phone at IARFC, the course work for each of the six classes takes about two hours of study, and a 60- to 90-minute exam must be passed after each of the six classes. The entire educational process for earning the RFC designation, she said, takes about 20 hours. According to the staff person, there are about 2,000 RFCs in the U.S. and 1500 overseas.

To maintain an RFC designation requires 40 hours a year of continuing education credit, which is a stiff number compared to the CFP Board minimum requirement of 30 hours of CE over two years for CFPs.

“Because there are no consistent licensing requirements for the various persons who call themselves ‘financial planners,’ the public has a critical need for a method of distinguishing the qualified and dedicated financial advisors,” says IARFC’s website.

What's It Mean

I would hope that Ed Morrow is wrong and CFP Board judged the allegation him based on the facts of the copyright violation complaint and not to settle a score. It's a tough call judging whether CFP Board could have set aside the complaint as a business issue and not revoked Morrow's use of the CFP, or privately admonished him.

CFP Board is likely not to say anything more publicly on the matter than it has already in its one-paragraph disclosure about the revocation, and we have only Morrow's explanation to rely on--that an employee made the mistake and Morrow was not involved in an unethical act of violating the copyright of the CPA firm.

But the reason I tried to give this such careful coverage is that we live in an era when one-time leaders in the financial planning profession are no longer embraced. The revocation of Morrow's license probably could not have happened in an earlier era. In an earlier time, Morrow might have been treated differently by CFP Board. As it tries to move CFPs from from salespeople to fiduciaries, the old guard of an era gone by could be discredited the same way political purges have turned yesterday's heroes into villains.

"They just don't appreciate what I've contributed to the profession," he says.

This Website Is For Financial Professionals Only

User reviews

There are no user reviews for this listing.