CFP Board Campaigns Against Advisor Rip-Offs Even As Its Rules Largely Exempt CFPs From Acting As Fiduciaries Hot

Even bolder, CFP Board on March 27 released a consumer guide in which it singled out the “Senior Certified Advisor” (SCA) designation and issued a warning to consumers: “The fact is that there are more than 170 known designations and certifications used by financial professionals,” CFP Board said in a statement. “Many of them are little more than marketing tools, with no real education needed —much less an exam—to ‘earn’ them.” (While there is no Senior Certified Advisor designation, incidentally, there is a Certified Senior Advisor designation.)

If CFP Board is serious about creating a licensing body that has credibility with consumers, it must first clarify its own rules, which essentially exempt CFPs from owing a fiduciary obligation in many—if not most—client engagements.

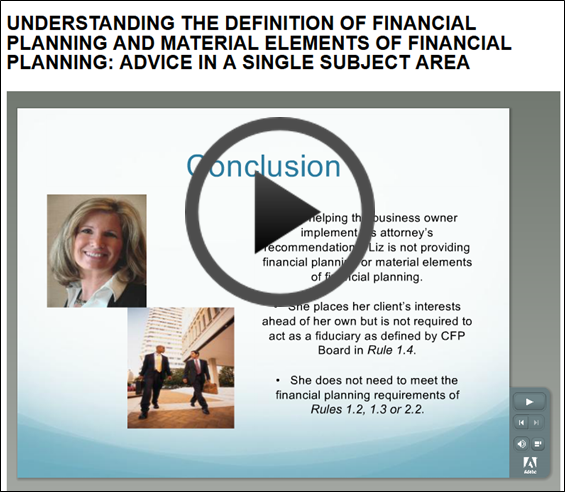

The CFP Board rule exempting CFP practitioners from acting as fiduciaries is spelled out in a video published on CFP Board’s website. The video, accessible by clicking on the picture below, is part of a series of multimedia presentations provided by CFP Board to guide practitioners in applying CFP Board’s Standards of Professional Conduct.

According to the CFP Board video, CFPs are required to act as fiduciaries only when they performing financial planning for a client. Financial planning is defined so narrowly, however, that most CFPs can easily avert owing a duty to act as a fiduciary to clients.

As the video on CFP Board’s website indicates, if a CFP is advising on a single subject area—like estate planning, college planning—a CFP is able to avoid owing a fiduciary obligation to a client. A CFP practitioner is, thus, allowed to sell clients products that pay commissions through a broker-dealer.

In contrast, a fiduciary cannot be paid on a commission basis. Commissions create an incentive to sell products, and to sell the products with the biggest commissions. So the CFP Board's rule provides CFPs with a huge out from always acting as fiduciaries.

Understandably, CFP Board cannot summarily decree that CFPs can no longer accept commissions. It would gut the business model of many, if not most, CFPs. It would also, arguably, not be in the best interest of consumers or advisors, but that's beside the point.

However, as CFP Board aligns itself with NAPFA and FPA in the Financial Planning Coalition, it is embracing a single fiduciary standard for registered reps and fee-only advisors. That position seems contradictory to CFP Board's own policy?

If CFP Board wants to be a credible protector of financial consumers, can it embrace a position effectively exempting many of CFPs from owing clients a fiduciary duty by allowing them to sell products? It’s a difficult issue. Do you think CFP Board is doing the right thing? What's the better way?