U.S. Stock Performance Remains Red Hot In The 3rd Quarter, Moving Into A 5th Year Of Rising Returns

In the first nine months of 2013, growth stocks, especially smaller growth stocks, have led the way with a 35% return, despite anemic economic growth, rising debt and global social unrest. Large-cap core companies earned 13% and large value earned 17%. Other than these extremes, style returns clustered around 23%, a pretty good place to be. On the sector front, consumer discretionary and health care companies have been hot with returns above 30%, while materials and utilities have not.

.jpg)

![]()

![]()

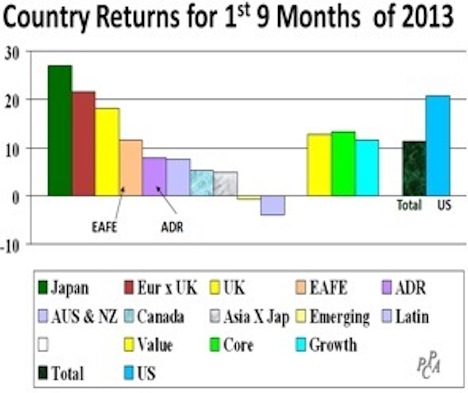

In foreign markets, Japan has outperformed the United States with a 27% return, and Europe has matched the United States’ 21% return. The rest of the world lagged, with Latin America losing 4% and Emerging Markets flat.

The most interesting details lie in the cross-sections of styles with sectors, especially if we are interested in exploiting momentum effects. Looking forward to the fourth quarter, I am forecasting winners in large-value consumer discretionary, mid-cap value health care and small-cap value industrials, and laggards in small-cap growth materials, small-cap core utilities & telephone, and large-cap core technology.

To see more details, including my results in forecasting winners and losers for the third quarter, check out the full version of my third-quarter market commentary. The full version also includes a survey and forecast for foreign stocks, special commentary on target date funds and hedge funds, and a link to an amusing new video that exposes the charade of hedge fund due diligence performed via peer groups and indexes.