- cash equivalents with 90% of a portfolio, while trading the balance in a variety of long and short positions in leveraged ETFs

- exotic (read: expensive) alternative investments to hedge downside-risk

- “tactical” bets on industries, countries or geographic regions

- ”go anywhere” mutual funds or hedge funds that free managers to make tactical bets

- quant-driven trading strategies

- currencies and private partnerships

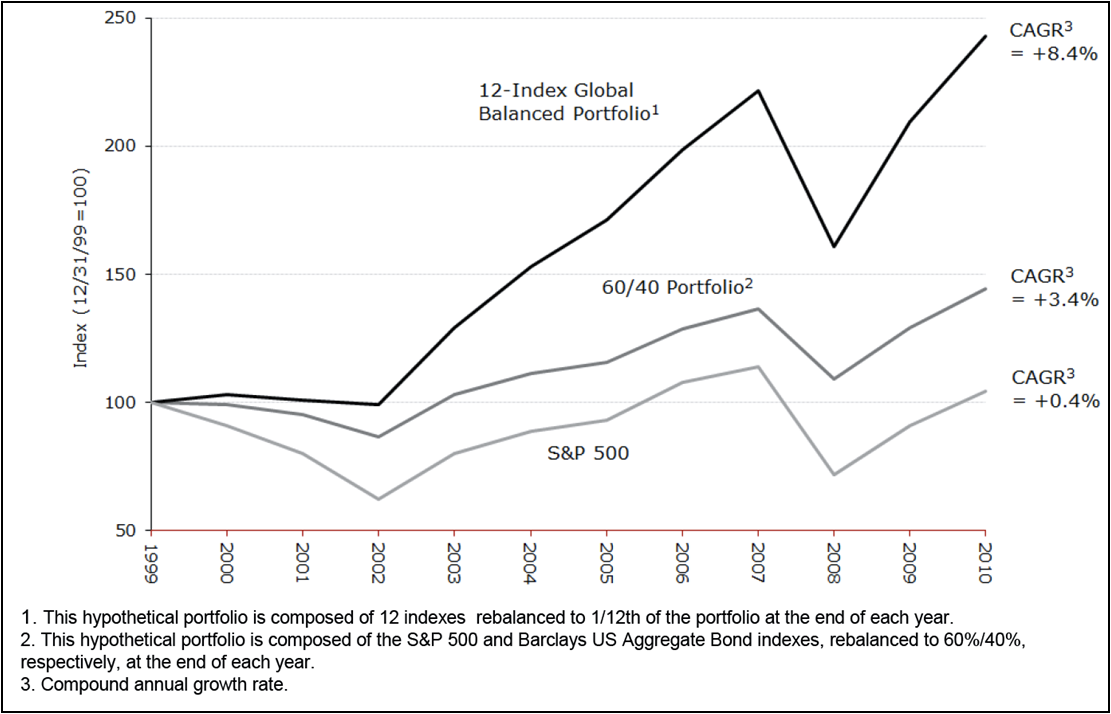

What you and your clients care about is performance. So let’s look at a globally diversified hypothetical portfolio from January 2000 through December 2010 that is rebalanced annually every December 31. Our hypothetical portfolio includes 12 equally-weighted asset allocations to indexes.

Such a portfolio validates the use of broad diversification, MPT, and buy-and-hold investing. Moreover, it is more easily implemented in a practice than market timing strategies and, thus, makes an advisor’s business more scalable.

Some fine print: 50% of our hypothetical portfolio consists of six allocations in stocks—U.S. large-, mid- and small-cap, foreign developed markets, emerging markets, and natural resources. The remaining four positions are allocated to bonds—U.S. and foreign—along with U.S. REITs and commodities. This hypothetical portfolio is rebalanced at the end of each year to equally weight each of the 12 indexes.

As you can see from the chart above, staying the course through the global financial crisis and U.S. mortgage meltdown has left nest egg in fairly good shape.

Craig Israelsen, a BYU professor of finance, has published an excellent and detailed treatment of similar calculations, including sensitivity analysis on how often to rebalance, in his book, 7Twelve: A Diversified Investment Portfolio with a Plan. I recommend reading it.

For my money, there’s probably nothing magical about precisely which global asset classes you use or how many. It’s the global diversification you’re after. And, of course, the stable-value portion of any portfolio needs to be calibrated to each investor’s risk tolerance, which, no doubt, has come into much better focus.

The data show how there was, indeed, nowhere to hide during the market meltdown. Had you been applying MPT by the book, you got creamed in 2008, although from the starting point in 2000 to the 2008 bear-market bottom the MPT portfolio’s, Compounded annual growth rate (CAGR) was less-than-disastrous 5.4%.

Further on this point, the subject of variable annuities comes to mind. Oh, yes, I’m aware that VAs get no respect in some circles. However, they are the only widely-available vehicle that would have protected a lifetime income stream tied to that 2007 portfolio high-water mark. That’s worth something and, of course, But I think VAs are a valid value proposition for many Americans. It wraps MPT with an insurance policy.

One other point deserves clarification. MPT is not synonymous with “buy-and-hold” You’re staying fully-invested, and it is buy-and-hold in that sense. Properly applied, however, MPT is a fairly active strategy. It requires periodic portfolio changes based on a qualitative assessment of each individual holding, as well as periodic rebalancing. In addition, sliding left on the Efficient Frontier, as a client ages, forces systematic portfolio adjustments over the long term.

Finally, to address a key issue facing every advisor: active versus passive. Should we do ETFs, index funds or actively-managed mutual funds? The correct answer is all of the above.

A June 2010 study by FundQuest BNP Paribas Group found that in 23 of 73 investment categories over the last 30 years, actively-managed mutual funds beat a comparable passive index. Conversely, passive beat active in 22 out of the 73. In the remainder, it was a toss-up. This might come as a surprise inasmuch the index fund and ETF vendors have pretty effectively promoted the notion that indexing is everywhere and always optimal. Not so.

So how have all of those “new” approaches to investing offered up in April 2009 performed in the past 30 months? Well, I can’t prove they were all a mistake, though I suspect many of them were, in fact, a recipe to miss the recovery. What I can say is that staying fully invested in a globally diversified portfolio very definitely has delivered.

You can do it with an array of indexes—mutual funds or ETFs—and actively managed funds. Don’t forget disciplined rebalancing, a key piece of the genius of MPT, because it forces systematically selling high and buying low, often precisely contrary to what the “smart money on Wall Street” is recommending.

It’s not rocket science but, occasionally in the career of every financial advisor, it takes guts to stay the course and remember that things will get better.

Fritz Meyer’s monthly research is relied on by many leading RIAs for client communications and marketing.

This Website Is For Financial Professionals Only

|

|

|

MEMBER REVIEWS

|

|

|

William Desormeau, Jr.

|

|

It is not possible for me to overstate the cumulative value that Craig, Bob and Fritz have added for over 10 years to my investment advisory practice, as well as for personal and family financial planning. A4A gets my highest recommendation

|

|

|

Lynn Najman, CFP®

|

|

I’ve subscribed to A4A since its inception, and always find it intellectually stimulating and on point. It’s one of the few CE solutions out there that doesn’t waste my time by pushing product or talking down to me.

|

|

|

| Pete Deacon, CPA, CFP® |

| A4A has had a profound effect on my business. Since 2009, I’ve relied on the consistent messaging and updates to run my business successfully. Being able to present the information from Bob, Fritz, and Craig's ongoing CE webinars has been a significant benefit. |

|

|

| Fredric Mayerson, MBA, PhD, CFP® |

| I've been a financial professional and professor of finance for 35 years and find Fritz Meyer and Robert Keebler to be among the most engaging, incredibly knowledgeable, and experienced presenters I’ve encountered. They deliver an extraordinary amount of information in an extremely interesting way — sequentially and developmentally, utilizing pedagogical tools and techniques that few possess. A4A to is the most consistently excellent CE program available. |

|

| Ron Roge, MS, CFP® |

| I’ve been attending A4A many years because the CE classes are outstanding, and my time is valuable. Though I have over 35 years of experience, I’m always learning something new on A4A. I attend fewer conferences now because the CE is generally not advanced. If you want to learn from the best, in a faster, easier, and less expensive way, I highly recommend A4A. |

|

|

John R. Day, CPA/PFS® |

|

I’ve been a member since 2011 and never miss the monthly webinars with Fritz Meyer. I appreciate Fritz’s independent views on the economy and markets and Bob Keebler keeps me updated on excellent tax planning ideas. A4A is a great value! |

|

|

Norman Politziner, CFP |

|

I wouldn't miss a Fritz Meyer webinar unless my pants were on fire. I've relied on Andrew Gluck's knowledge systems --client communications and CE -- for two decades. It's simply the best solution for tax, financial, investment, and risk-management professionals.® |

|

|

|

Dan Hawley, CFP® |

|

A4A, for over a decade, has been a great resource for useful and accurate information and CE. A4A and Advisor Products are bargains for an advisory practice. |

|

|

Kevin Brosious, MBA, CFP®, CPA/PFS® |

|

I get CPA CE credit and CFP credit for the webinars. But not only that, the A4A content is terrific |

|

|

|

|

|

|