Twisted Wreckage: Why The Fed's Operation Twist Set Off Today's Selloff In Stocks, And An Assessment Of Current Economic Data

The S&P 500 dropped like a stone following the Fed’s introduction of “Operation Twist” yesterday. What don’t investors like?

Investors have concluded that Quantitative Easing 2.0 (QE2) didn’t create jobs or stimulate growth. Twist now makes it appear that the Fed is running out of tools, grasping at straws.

“The maturity extension program will provide additional stimulus to support the economic recovery but the effect is difficult to estimate precisely,” according to a release about Twist by the Fed yesterday.

Moreover, Twist carries with it some potential downside. Flattening the yield curve is bad for financial services stocks, just when investors want to see them strengthen. In addition, near-zero yields hurts savers. Plus, long-term Treasury bonds will decline in value and complicate the Fed’s exit strategy when it someday sell the bonds it has purchased under QE2. Moreover, while the Fed yesterday said it expects a pickup in the pace of the recovery over coming quarters, it darkened its assessment of the downside risks in its outlook.

With gloom hanging so heavy on investors, here are key pieces of the puzzle to stay focused on.

Yes, it is possible that the stock market is simply out in front of the data and accurately predicting a significant economic deterioration. But it’s also possible that the stock market is too pessimistic. In fact, stocks arguably present great value now. That’s always hardest to believe in times like this.

It is possible that the August-September stock market plunge has already discounted as much slowing in the economy as we’re going to see, and the drop in stock prices may already have factored in the disappointing pace of the recovery.

I believe this correction, at a minimum, is a good chance to rebalance. Selling bonds and buying stocks, as your baseline allocation might dictate, remains the best approach for long-term investors. I’m staying comparatively upbeat because much of the data still looks good. Here are examples.

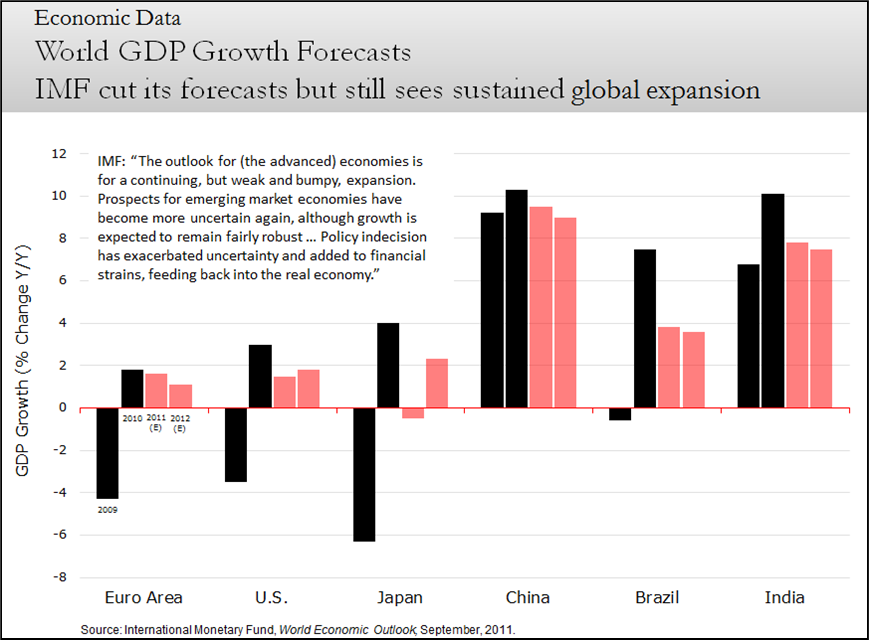

The IMF just released its September World Economic Outlook in which it cut global growth forecasts but it continued to forecast a sustained global expansion as the most-likely scenario.

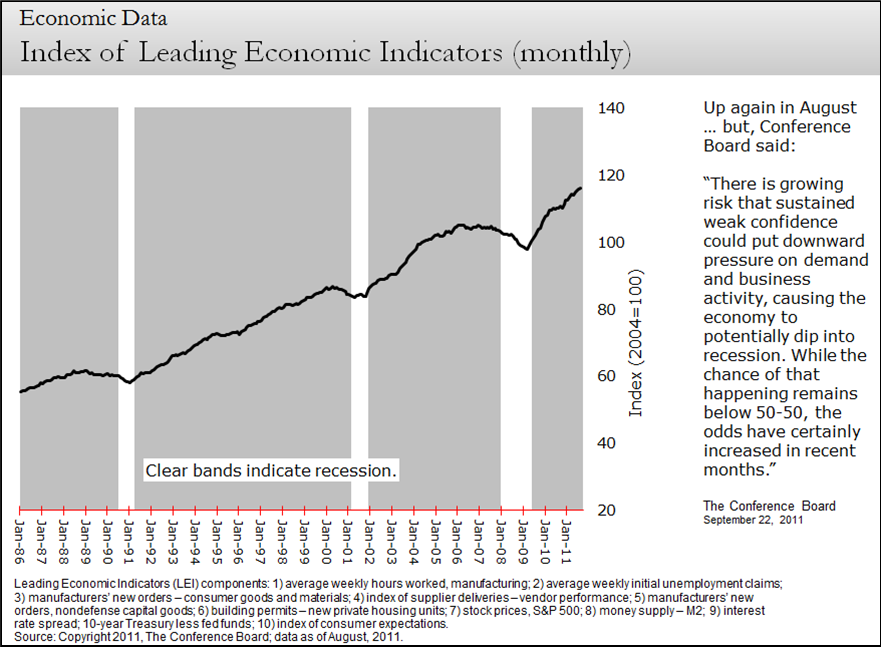

In the U.S., this morning’s uptick in the August Index of Leading Economic Indicators was good news, although the Conference Board pointed to growing downside risk to the economy posed by weakening consumer confidence.

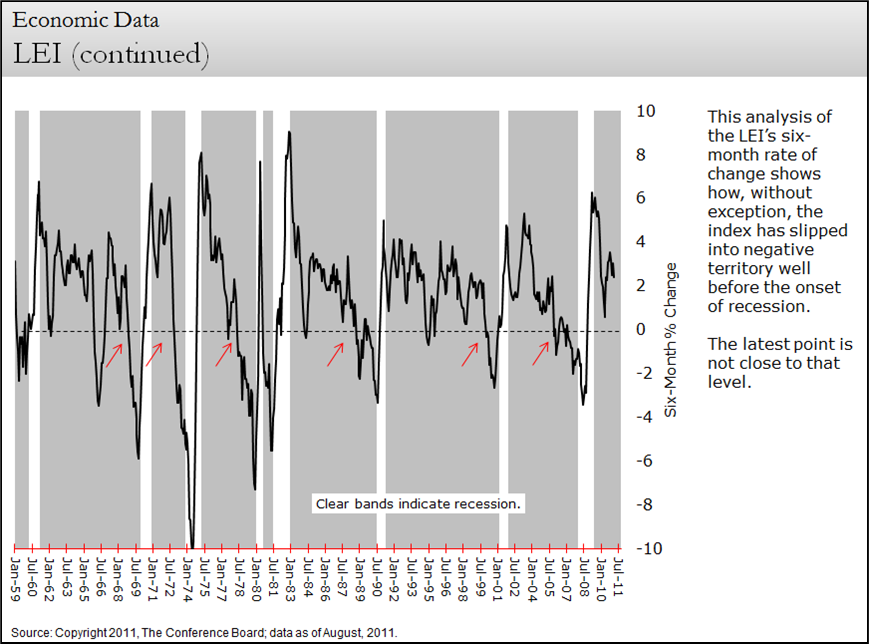

A closer look at the LEI puts current conditions in perspective. Historically, the six-month rate of change in the LEI has foreshadowed every recession without exception.

Maybe this time it will be different. But the LEI would need to deteriorate significantly from current levels before I’d become negative on stocks and bet that we’re entering another recession.

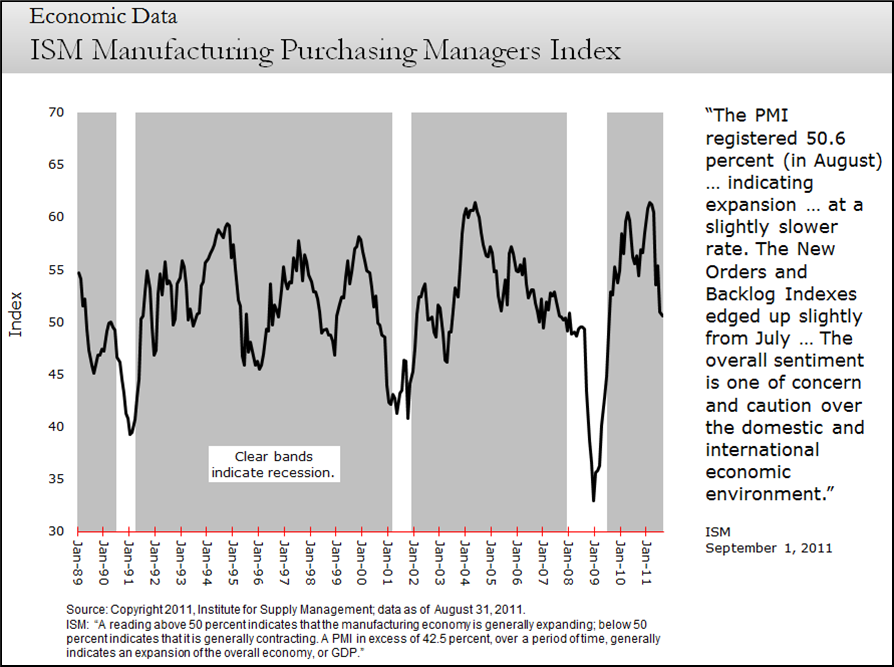

Also keep in mind that although the ISM manufacturing purchasing managers’ index ticked down in August, in the context of this barometer’s volatility historically, it is not setting off alarm bells.

To the contrary, the ISM non-manufacturing index actually showed an uptick in August.

This barometer gets less attention than the manufacturing index because it has only been around for three years. However, it is very significant inasmuch as non-manufacturing comprises the bulk of U.S. economic activity.

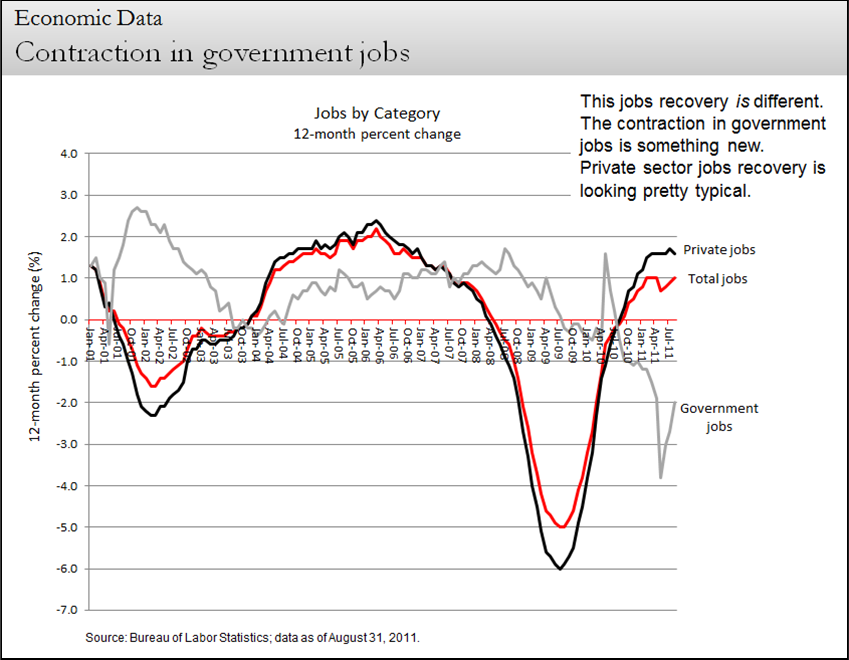

Along the same lines, August new job formation slumped to zero and was very disappointing.

However, the recovery in year over year private-sector job growth is encouraging.

Public sector job shrinkage has probably run its course insofar as state and local governments had to balance their 2012 budgets for the fiscal year that began in July.

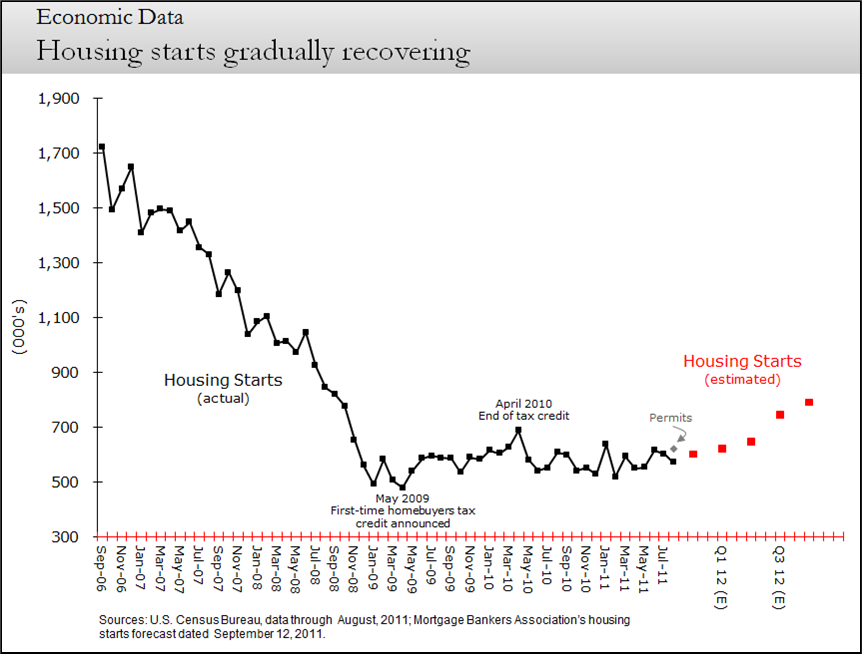

August housing starts, reported this week, continue to bump along the bottom, although the trend from the 2009 bottom is slightly positive.

Note, too, that the August housing permits figure and the Mortgage Banker Association’s latest housing starts forecast, suggest further gradual progress ahead.

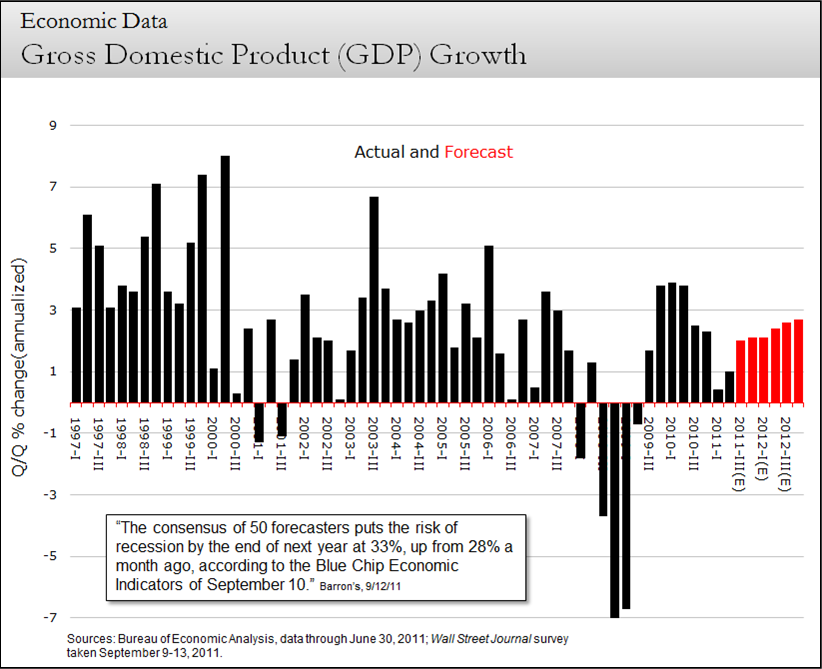

And the latest data suggest to the 55 best economists surveyed each month by the Wall Street Journal a continued recovery over the next six quarters, though Blue Chip Economic Indicators’ survey shows that the risk of another recession rose to 33% from 28% last month.

They could all be badly mistaken, of course, and the economy could be at much greater risk—as the stock market would seem to be telling us—but economic experts currently are not nearly as pessimistic as stock investors.

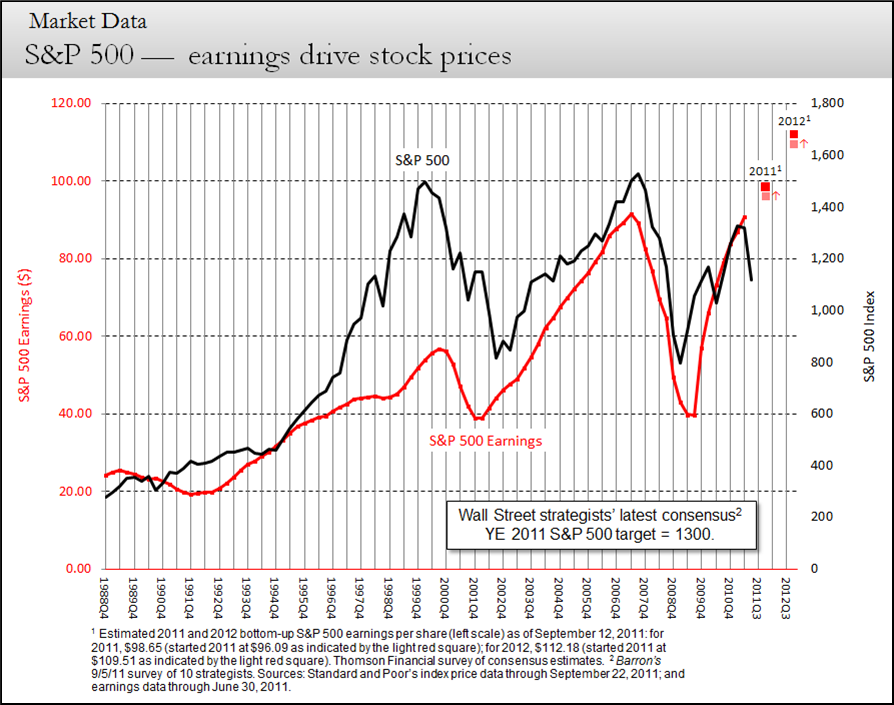

The latest consensus forecast for corporate earnings is shown in the chart below. I like to follow analysts’ company-by-company earnings forecasts because these people actually talk to company managers every day. To me, their bottom-up analysis of the business outlook is thus more reliable than Wall Street strategists with their “top-down” earnings forecasts based on econometric models.

Plotting today’s S&P 500 earnings estimates against the S&P 500 Index results in the following chart. If we come anywhere close to the forecasted ~$98 per share in earnings this year, I would have to believe stock prices will end the year a good deal higher than at today’s level.

Finally, my view of Europe’s mess is simple. Greece will probably default and we’ll see periodic anxiety attack the credit markets and then spill over into stocks for a long, long time. That’s because the Eurozone’s problems require political solutions. That takes time.

But Europe’s banks will not be allowed to fail. They must be and, therefore, will be re-capitalized. That being the case, the doomsday scenario for the global financial system is off the table. Periodic stock market plunges resulting from this particular worry thus provide opportunity.