Foreign, Commodities, Fritz Meyer And MPT

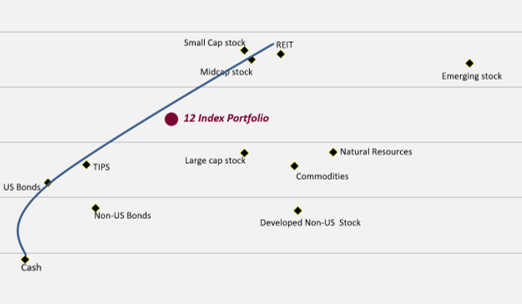

Craig Israelsen, Ph.D., reviews the performance of a broad array of asset classes, with a focus on the performance of non-US equity and commodities over the past two decades. Craig talks about comments by Fritz Meyer’s at a Feb 12, 2019 CFP® CE webinar in which Meyer said that foreign and commodities have fallen off the efficient frontier and no longer are justifiably incuded in a broadly diversified portfolio.

“Thanks, Craig, for more enlightenment on the differences in the performance of various indexes in the identical asset class,” said Andrew Fama, J.D, AEP, RF of Rochester, NY said in his review of the session. “I suppose the lesson to be learned is that one should not arbitrarily assign any old index fund to one's portfolio without doing further investigation on performance differences within the same asset class.”

The reviews from other attendees are below.

- Excellent perspective on long and short term data

- I always enjoy listening to Craig. He gave me more confidence putting commodities into portfolio's by showing the cost in a low inflationary environment over the last 20 years.

- Thanks Craig for more enlightenment on the differences in the performance of various indexes in the identical asset class. This is something that I was frankly not aware of, so I appreciate you setting the record straight on that. I suppose the lesson to be learned is that one should not arbitrarily assign any old index fund to one's portfolio without doing further investigation on performance differences within the same asset class.

- It was OK, not the best one from Craig

- Good retort...look forward to your alt msci and green data crunching

- OK, I think the EAFE Index (choice of funds to use) was a bit confusing

- Good but a bit unclear in addressing the purpose of the presentation in light of the reference that the webinar was held to clarify the issues raised by Fritz in an earlier webinar. The presentation did not seem to address the core issue of under-performance of EAFE as more than an issue of "timing". It did a better job with commodities but it seemed more time was spent on the EAFE discussion with a less compelling narrative.I expected the session would more closely respond to Fritz's comments rather than point to alternative indexes as the solution. It was helpful and Craig made good points about not knowing the future, so overall it was worth the time.

- Good but it was nice to see the drilling down on MSCI EAFE

- Excellent explanation of the complexities of making judgements about performance.

- I would like to see a deeper drill down into better options to the EAFE index.

- Material could have been presented in 1/2 the time. Too much redundancy.

- Love this stuff! Looking forward to further developing the idea.

- Awesome.

- Super smart. Knows his topic inside out. Communicates very well. I trust him and what he says. Convincing data.

- Craig does an exceptional job of presenting his topics visually and audotorily

- I thought Craig spent too much time going over his 7Twelve Model and more time could have been spent on the last part supporting his reason for including foreign equities and commodities in a portfolio.

- Craig always gives wonderful webinars.

- Very excellent and timely response to the comments made by Fritz in his presentation.

- Great Session. Looking forward to the region and company drill down

- Good rebuttal to Fritz. (-:

- Very good

- Helped understand performance history with international and commodities

- Good information. I am looking forward to more information on commodities. I would appreciate insight on alternatives and private equity as well for investments beyond the core portfolio (beyond the 7Twelve).