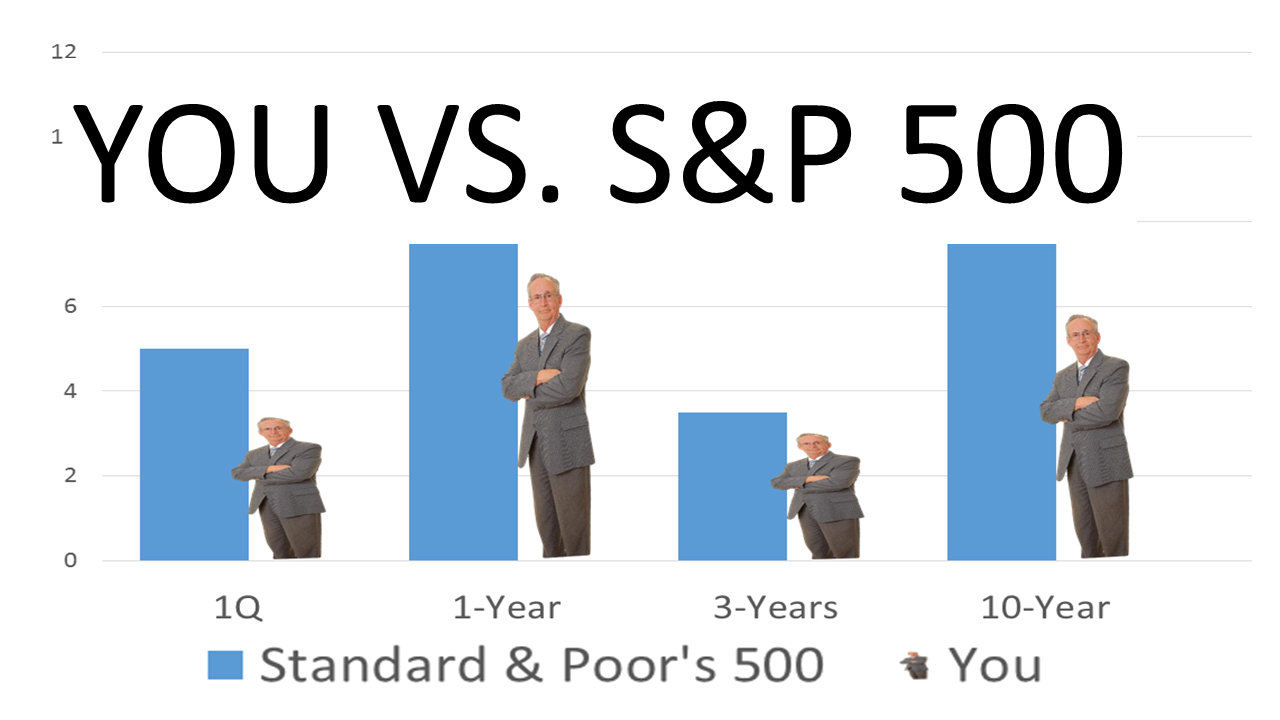

Stocks Rose Sharply In 3Q2012 And For The Past Year; Are You Putting It Into Perspective For Clients In Quarterly Reports? Hot

Write Review

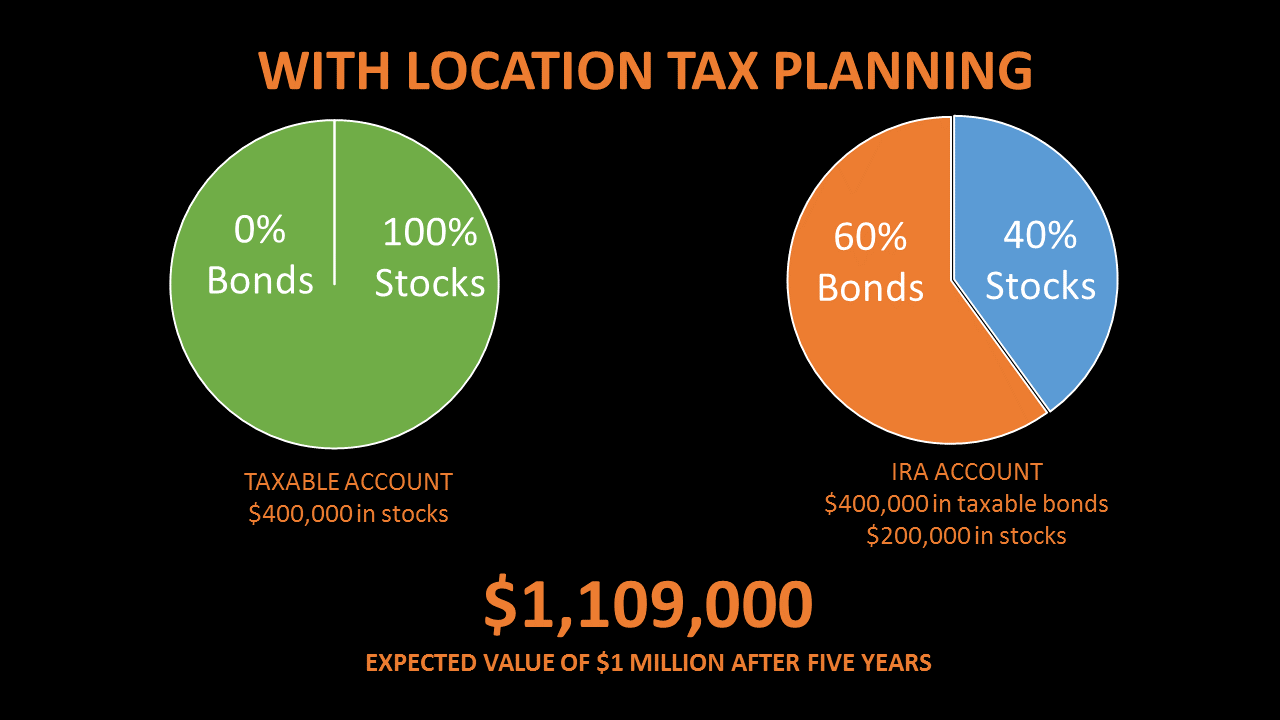

Provided as a Microsoft Word document, you can choose excerpts of Quarterly Market Summary (QMS), edit them and brand them.

QMS is also provided as a PowerPoint slideshow that you can deliver in client meetings, webinars and seminars.

Many advisors provide quarterly perfromance reports online or in the mail but do not give clients perspective for understanding them. QMS provides crucial analysis that help RIAs maintain relationships with high-net-worth individuals.

Some excerpts from this quarter’s summary:

“Only investors setting a long-term strategy based on their personal risk tolerance could have participated in the unlikely bull-run. It began three years ago, after the worst financial crisis in decades. Only investors broadly diversifying, setting an investment policy, and maintaining a long-term commitment to stocks and other major asset classes could have benefited from this bull-market.”“Slow growth has characterized the rebound since the global financial crisis. That has led the Federal Reserve to keep interest rates low to provide liquidity to the economy. Interest rates have stayed at historic lows for months and the Fed has said it expects to continue its easy monetary policy into 2014. The yield on the 10-Year U.S. Treasury Note has stayed low and that has made stocks attractive relative to bonds.”“Slow growth, at best, for America seems likely, but Europe is in recession and is likely to stay so through much of 2013, as growth is slowing markedly in China. The U.S., which started the global financial crisis, is now the world’s best hope to continue to lead the recovery, and an accommodative Federal Reserve is likely to continue to provide the same easy money policy that helped fuel the stock rally of the past three years.”

User reviews

There are no user reviews for this listing.