Odds For Investment Success Worsen When Investors Select Two Or More Actively Managed Funds In An Asset Class

Guest post from index fund expert Rick Ferri:

Portfolios holding only actively managed funds have a low probability of outperforming a comparable all-index-fund portfolio. In A Case for Index Fund Portfolios, a whitepaper I co-authored with Alex Benke, CFP© of Betterment, we show that portfolios of actively managed funds have a low probability of outperforming an all-index-fund portfolio. (On Friday, I am speaking at an Advisors4Advisors webinar about the results of the study.)

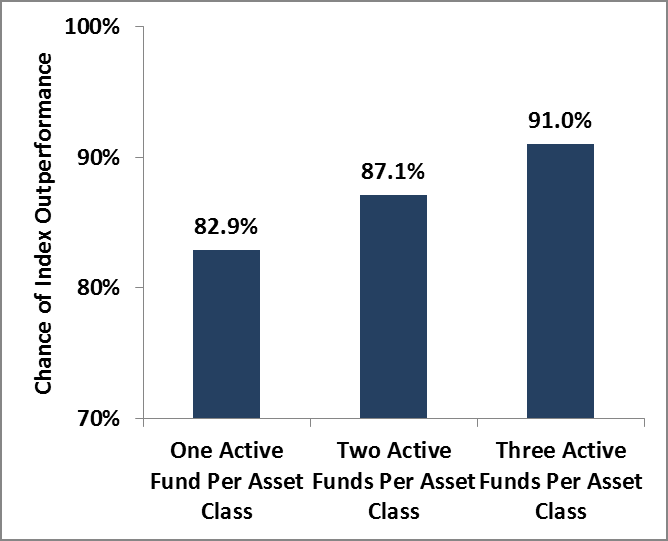

Our research shows that when investors select two or more actively managed funds in an asset class, they reduce the chances of outperforming an all–index fund portfolio. Figure 1 illustrates the outcome of one scenario in our study. It covers three asset classes over the 16-year period from 1997 to 2012. The benchmark portfolio invested 40% of its assets in the Vanguard Total Bond Market Index (VBMFX), 40% in the Vanguard Total Stock Market Index (VTSMX), and 20% in the Vanguard Total International Stock Index (VGTSX).

Figure 1: Probability of an all-index-fund portfolio outperforming an all-actively-managed fund portfolio.

The three-index-fund portfolio outperformed the one actively managed fund portfolio 82.9% of the time. When two actively managed funds were selected in each of the three asset classes (a total of six funds), the odds in favor of the all-index-fund portfolio increased to 87.1%. Finally, when three actively managed funds were selected in each asset class (a total of nine funds), the odds reached 91.0% in favor of the all-index-fund portfolio.

This finding has meaningful implications for mutual fund investors, and should be of particular importance for participants in self-directed employer sponsored retirement plans. An all-index fund portfolio has a high probability of outperforming actively managed funds. However, if actively managed funds are selected, it’s generally better to pick one fund per asset class and hope for the best.

Past performance does not guarantee of future results. Portfolio Solutions® will make a list of all recommendations within the immediately preceding period of at least one year available upon request.

This Website Is For Financial Professionals Only