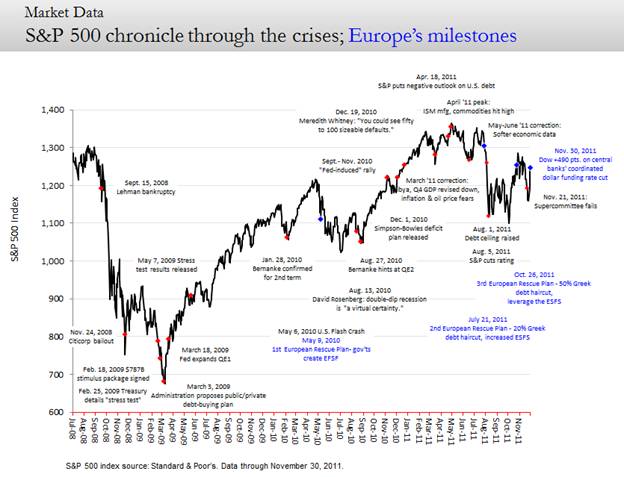

A 7.2%, 800-Point Gain In Three Days! What's The Story?

Second. The central banks’ move followed the news, leaked over the weekend, that Eurozone leaders are hammering out new rules to make fiscal discipline legally binding, which they could accomplish with a new treaty among the 17 euro-currency countries without having to amend the 27-member European Union treaty. A way around that treaty has been seen as crucial to a necessarily quick solution to the urgent European debt crisis. The rumored deal would, indeed, be a giant step forward because its goal is to provide the European Central Bank (ECB) with a sufficient guarantee that the massive bond purchases it will be required to make – the "bazooka" unleashed by the Fed in this country's crisis – won't simply relax the pressure on the southern European countries to make the very difficult required deficit cuts.

Third. Not to be overlooked among the reasons behind this monster stock market rally are several important pieces of good U.S. economic data.

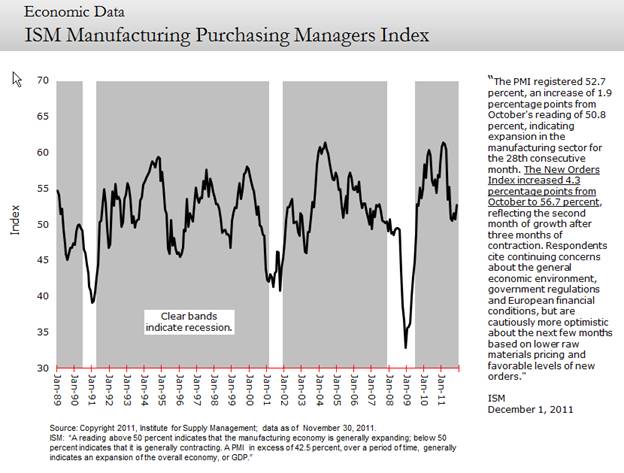

- The Chicago-area PMI came in much better than expected and this morning’s release of November’s national ISM manufacturing purchasing managers index was also better than expected, importantly with strong new orders – a forward looking component.

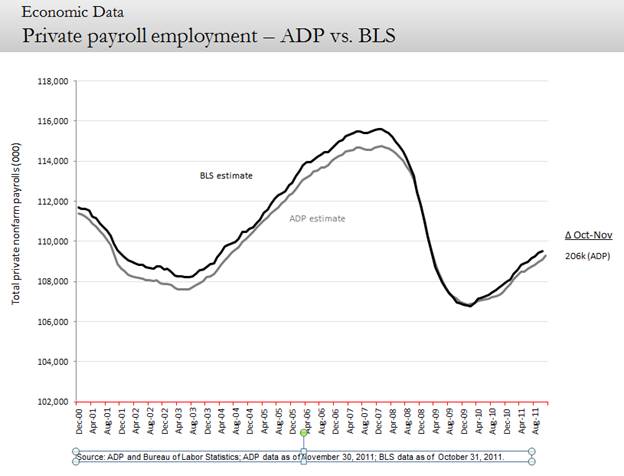

- ADP's monthly employment survey showed a better-than-expected +206,000 rise in private sector jobs, which suggests more new jobs on the Bureau of Labor Statistics monthly jobs report to be released tomorrow (Friday) morning than are presently forecast.

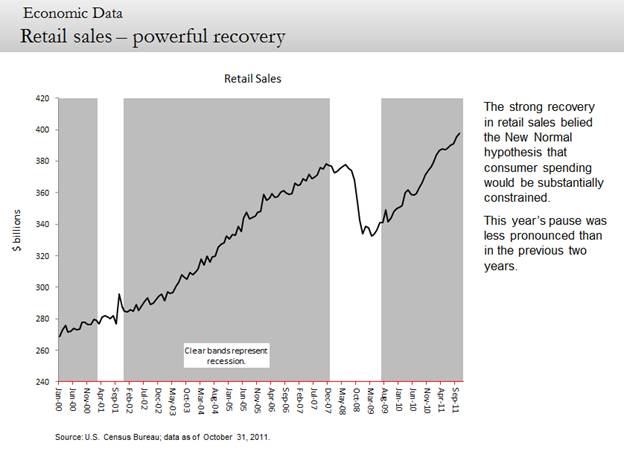

- October's pending home sales, reported yesterday, surged. November vehicle sales, reported today, are coming in strong. Retail sales, generally, have been gaining at a surprisingly good clip.

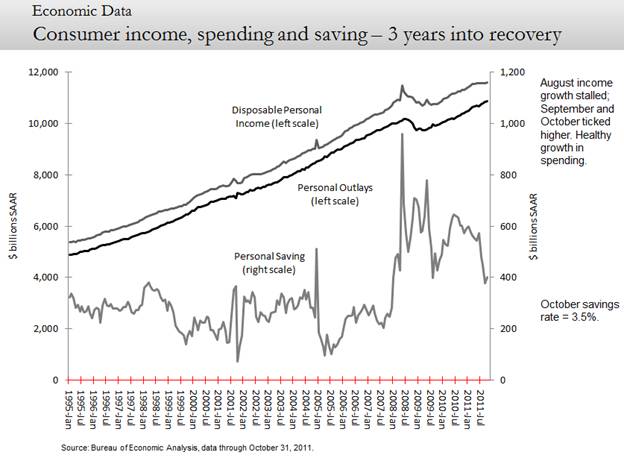

- And, finally, this observation on the October personal income and spending data reported last week but overshadowed by the Euro crisis. This is among the most important monthly data insofar as consumer spending is 70% of the GDP, and it is encouraging. Disposable personal has resumed its upward trajectory following some summer flattening. Personal outlays posted another healthy advance. November's higher consumer confidence reading, posted Tuesday of this week, suggests continued strength in spending ahead.

So, here’s the story – Cliff Notes version. Investors got a) some new and credible encouragement that the euro currency won’t go extinct, leading to a collapse in the euro-zone economies; b) new evidence that the U.S. and rest-of-world economic expansions aren’t faltering. Stock market valuations had once again slumped into territory that looked obviously cheap to many investors and the collection of good news provided the spark for a boffo rally. Europe is still calling the stock market’s shots. Investors will require more substance to the new treaty plan from their summit meeting on December 9th . Stay tuned.