The Moral Compass Of The Financial Advice Profession Is Being Reset, As Fee-Only Advisors Are Tarnished Again By Scandal Hot

In May 2009,James Putman, owner of an Appleton, Wisconsin RIA and who served as NAPFA president immediately before Spangler, was charged by the U.S. Securities And Exchange Commission with accepting $1.24 million in kickbacks.

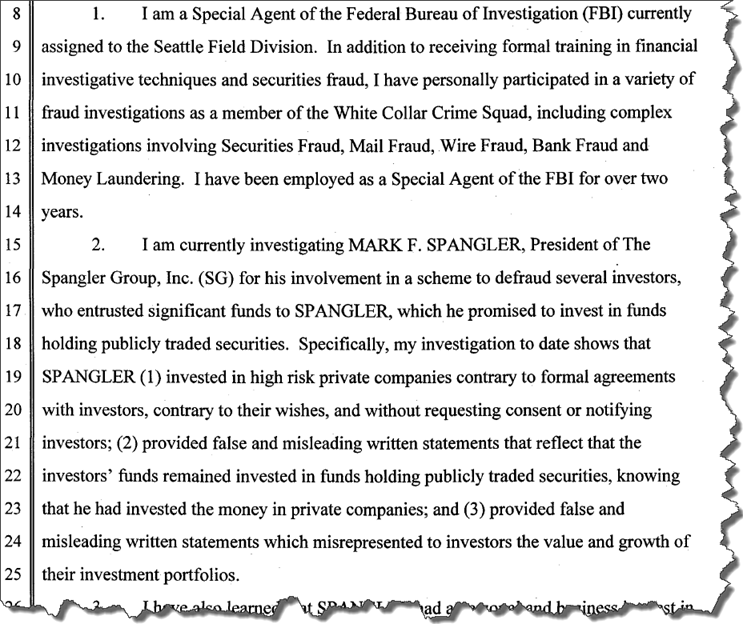

For the fee-only advisor movement, allegations of fraud against two former NAPFA presidents are so sad. Apart from the human tragedy for Putman and Spangler as well as clients they allegedly defrauded, corruption charges against two former luminaries in the fee-only movement shatter any illusion that one mode of advisor compensation is morally superior to another.

It’s not the mode of compensation that determines whether an advisor is honest. It’s the advisor.

NAPFA, which was founded in the early 1980s, has always been regarded as a beacon in the financial advice industry. In the consumer press, reporters routinely cite NAPFA as a source for consumers looking for a financial planner. NAPFA has been a lead-generation machine for its members, outflanking the Financial Planning Association with this key member benefit.

At the New York Daily News and Worth from 1986 to 1996, I was one of many reporters in the consumer press who mentioned NAPFA in stories frequently. I used NAPFA’s membership directory to find sources fast. It was like a Rolodex. Like the rest of the financial press, I bought the notion that fee-only advisors are morally superior.

From 1996 through 1998, when Mark Spangler led NAPFA, I was transitioning from the consumer press to the trade press, and I launched a client newsletter business. Initially, I only sold my client newsletters to fee-only advisors because I was worried that a commission-taking advisor might use my words to rip off an investor. That’s how much I believed in the moral superiority of fee-only advisors.

And that’s why I am so deeply saddened by allegations of fraud against Spangler. Fee-only advisors portrayed themselves as more ethical than other advisors. They were supposed to be better than this.

Over the last decade, however, I suspected the day was coming, when being fee-only was no longer a legitimate differentiator among advisors. It's happened in slow motion, but it is still so upsetting. People get corrupted. They make compromises and lose their integrity. Fee-only advisors are ultimately about as dishonest as the next guy.

Where does this leave the financial advice profession?

I believe the moral compass of the profession is being reset.

To be sure, scandals involving the leaders of the fee-only only advice movement forever end the right of fee-only planners to claim moral superiority. They deal a deal a fatal blow to the notion that advisors working on a fee-only basis are more ethical than those who accept commissions.

NAPFA members for years have looked down on advisors who accept commissions, saying it was an inherent conflict of interest. Meanwhile, many advisors who accept commissions have said NAPFA members display an unwarranted "holier than thou" attitude.

If reason were to prevail, both sides would coalesce around mutually beneficial professional standards. Now that it is clear that mode of compensation is not the determining factor in defining standards in the financial advice profession, other approaches can become the focus. That could be good.

NAPFA should issue publicly address the integrity issue. Serious soul-searching is needed.