Helping Clients Figure Out When To Take Social Security

For those who are in relatively good health and do not need social security payments to meet current expenses, it can be a good decision to wait until the person’s FRA or even as long as possible (age 70) before taking benefits. The reasoning is straightforward: People will be penalized if they start their benefits early and they will receive a credit if they delay their benefits.

If a person decides to receive benefits before reaching the FRA, the benefit amount will be reduced by 0.56% for each month before that age, up to 36 months. If they receive benefits more than 36 months before the FRA, the benefit is further reduced by another 0.42% per month. But by delaying the first year in which they receive social security benefits until after the FRA, the monthly checks will be higher over the long-run by as much as 8% each year until the recipient reaches age 70.

The best way to take the benefits, penalties, and any credits into account is to look at a break-even analysis, which I performed using our free calculator called When to Take Social Security. I also used our retirement planner to analyze the situation by running scenarios on social security payments.

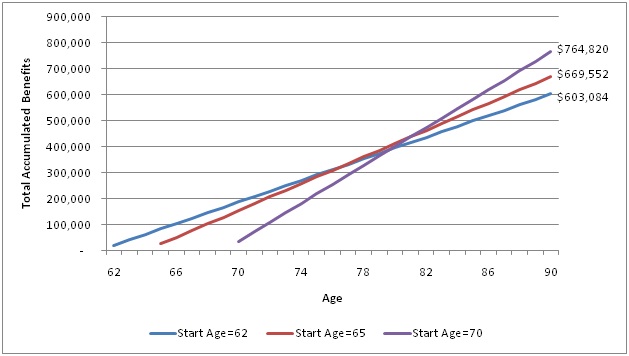

It is very informative to see at which age the total accumulated benefits break-even with, and then surpass, the accumulated benefits that occur when taking social security at earlier ages.

The chart above assumes that this person turns 62 next year and has made $70,000 per year (in today’s dollars) for the past 35 years. Also, all projected dollars are in today’s dollars and are not adjusted for inflation.

Let’s start by looking at how this person fares when taking benefits at age 62 vs. age 65. By delaying the first social security payment to age 65 this person will break-even vs. taking the first payment at age 62, in terms of accumulated benefits, when he is 77 years old. If he then lives until age 90, he will receive over $66,000 more during his retirement. Waiting until age 70 gives this person a break-even that is similar. The break-even vs. taking the first payment at age 62 would be 78 years old. The difference in accumulated benefits, if he lives until age 90, would be nearly $162,000.